As I noted earlier, a few weeks ago Treasury fired the head of FinCEN, Jim Freis. (FinCEN makes sure that financial institutions report whatever evidence of potential crimes they’re seeing.)

As I noted earlier, a few weeks ago Treasury fired the head of FinCEN, Jim Freis. (FinCEN makes sure that financial institutions report whatever evidence of potential crimes they’re seeing.)

American Banker reported that Treasury wanted “additional focus on international areas such as terrorist financing,” and less focus on “other financial crimes such as mortgage fraud.”

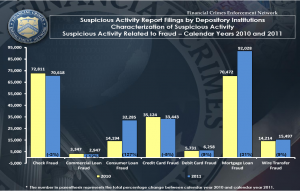

Three days before he was fired, FinCEN released this report, showing in aggregate what all of last year’s Suspicious Activity Reports revealed. It shows that among the SARs from depository institutions (which make up over half of all SARs), reports of terrorist financing and hacking (computer intrusion) are going down, while reports of behavior targeting consumers–mortgage and consumer loan fraud–are going up (though it notes the mortgage loan fraud reports are inflated because some date from years ago).

- Reports of Terrorist Financing declined 14%, from 711 instances in 2010 to 609 for the same period in 2011.

- The number of depository institution SARs identifying Mortgage Loan Fraud as a Characterization of Suspicious Activity continued to rise (up 30.6% in calendar year 2011). Quite markedly, Mortgage Loan Fraud is the only summary characterization that has experienced an increase every year since 1996, with the past two years (2010 and 2011) accounting for nearly 37% of all noted instances of this specific activity for the last decade. Note that depository institutions may submit Mortgage Loan Fraud SARs well past the actual date of the activity. This upward spike in mortgage fraud counts is in predominant part attributable to mortgage repurchase demands and special filings generated by several institutions.4

- Of the eleven reportable suspicious activities that experienced decreases, none saw greater than Computer Intrusion, falling 21% in 2011 as compared to those filed in 2010. For the second year in a row, this drop is amongst the largest of any of the defined summary characterizations.

- Though having experienced decreases in 2009 and 2010, the number of reports indicating Consumer Loan Fraud (in whole or part) significantly rose in 2011, up 127% from the prior year.

Such trends are similar to what the report shows in the securities and futures industries, with an even bigger drop in terrorist financing and big gains in futures fraud, embezzlement, and insider trading.

- Embezzlement/Theft saw the second largest gain of any of the suspicious activities reported in SAR-SF filings, rising 38% in CY2011. However, of the 21 Types of Suspicious Activity listed, Futures Fraud saw the biggest rise (up 85%) for the same year, increasing from 20 instances in 2010 to 37 instances in 2011.

- Likewise, Insider Trading (+34%) and Forgery (+19%) also experienced double-digit growth, making them the only two distinct activities that have continued to rise every year since 2003.

- Of those activity types showing a decrease, Bribery/Gratuity (down 74%) and Terrorist Financing (down 59%) both saw a sizeable drop between 2010 and 2011, with the former down from 69 reported instances last year to just 18 in 2011 and the latter falling from 46 instances in 2010 to a low of 19 twelve months later.

Remember, SARs are not a reflection of what Freis demands (nevermind the fact he’s been on the job when things like terrorist financing were higher). Rather, this is what banks and securities firms self report, as mandated by law, about what they’re seeing in their own records.

Jim Freis showed that terrorism is getting better and bankster crimes are getting worse. And then Treasury fired him.

And the report from American Banker suggests that by replacing Freis, Treasury may intend to have FinCEN dictate what financial institutions prioritize. Which will mean terrorism–and not the crimes of banksters–will once again be the focus.

Fincen is likely to take a higher profile when it receives new leadership. In the immediate aftermath of the Sept. 11 attacks, Fincen was very active in dealing with bank regulatory matters, including helping to shape policy on anti-money laundering requirements. But the financial crisis largely pushed Fincen to the side and the agency focused on many of its other responsibilities. Treasury appears to want Fincen to take a larger role in terrorist financing activities and possibly reassert itself in the bank regulatory sphere. In past few years, banks have not had to focus on what Fincen’s agenda was. A more assertive Fincen changes the equation.

FinCEN offers one objective read of the relative prevalence of various forms of financial crime. And last year, it showed that banksters were a growing problem and terrorists a shrinking one.

And that message was so dangerous to the powers that be, it appears, Treasury decided to kill the messenger.