Why Would Allen Weisselberg Tolerate Having to Cheat on His Taxes Rather than Getting a Raise?

I want to pull several salient facts out of the indictment against Trump Organization CFO Allen Weisselberg and Trump Organization rolled out yesterday. The indictment alleges that the Trump Organization paid Weisselberg and other Trump Org executives off the books in such a way that allowed them to underpay their taxes.

The purpose of the scheme was to compensate Weisselberg and other Trump Organization executives in a manner that was “off the books”: the beneficiaries of the scheme received substantial portions of their income through indirect and disguised means, with compensation that was unreported or misreported by the Trump Corporation or Trump Payroll Corp. to the tax authorities. The scheme was intended to allow certain employees to substantially understate their compensation from the Trump Organization, so that they could and did pay federal, state, and local taxes in amounts that were significantly less than the amounts that should have been paid. The scheme also enabled Weisselberg to obtain tax refunds of amounts previously withheld.

It goes through one after another way that Weisselberg was paid in this way:

- A lease on a Riverside apartment that was Weisselberg’s full time residence (which, scandalously, was not owned by Trump)

- For some years in which he lived in the Riverside apartment, the ability to claim he was not a resident of New York City and so avoid taxes there

- Private school tuition payments for his grand-kids

- Use of two Mercedes

- Cash to pay his holiday gratuities

- Some compensation paid by the Mar-a-Lago Club and Wollman Rink Operations LLC as non-employee compensation that he dumped into a Keogh plan (this appears to be the same scheme that the NYT described Ivanka being paid as a consultant under)

It makes it clear he was in charge of this system — the entire system, just not the part that benefitted him, but also the parts that benefitted his own kid and Donald Trump’s kids.

At all relevant times, Weisselberg had authority over the Trump Organization’s accounting functions, including its payroll administration procedures. He supervised the Comptroller of the Trump Organization, who managed the day-to-day affairs of the accounting department, including payroll administration, and who reported to Weisselberg. At all relevant times, Weisselberg was authorized to act on behalf of the Trump Corporation and Trump Payroll Corp, to formulate corporate policy, and to supervise subordinate employees in a managerial capacity.

Thus far I get how this is supposed to work: Weisselberg has thus far been charged only for the tax fraud that benefitted him. If he doesn’t cooperate, his kid will be charged for the tax fraud that benefitted him, and Weisselberg will also be charged for the tax fraud that didn’t benefit him but over which he was in charge anyway.

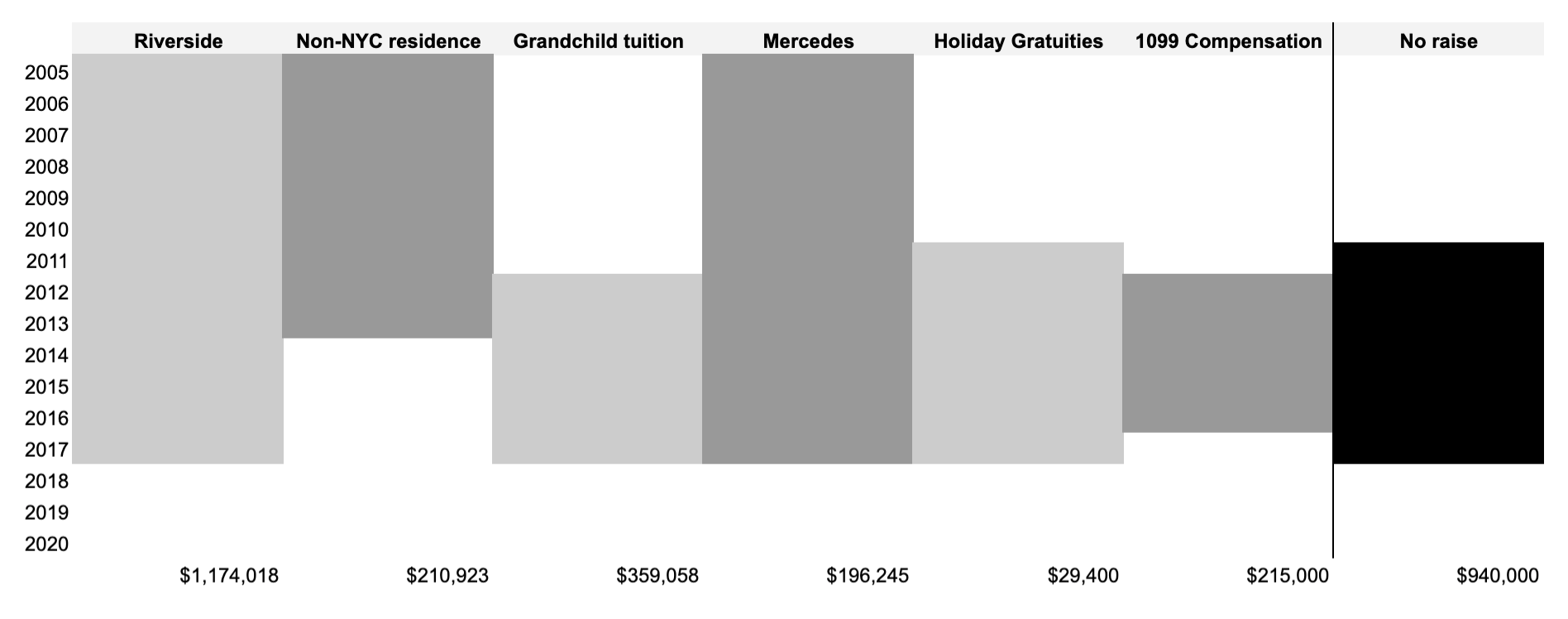

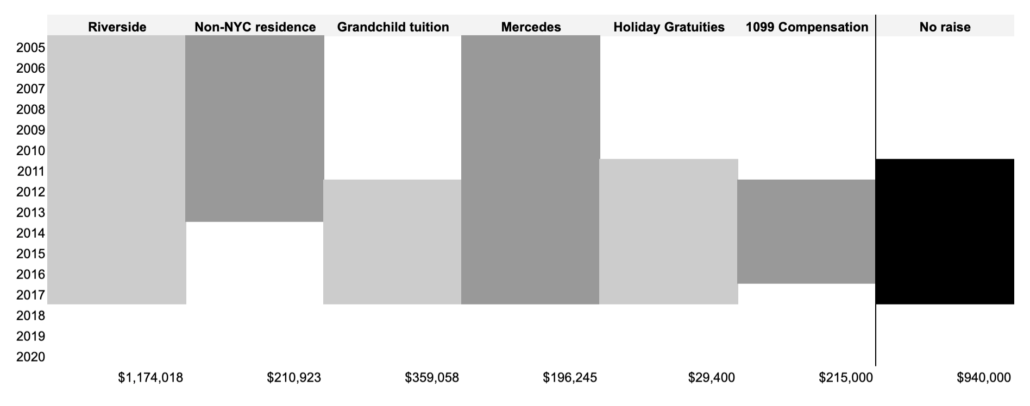

What I don’t understand is this. Before the indictment was revealed, some well-informed people had assumed that all the fringe benefits — the free tuition, the free car, the free apartment, the free tips — were on top of Weisselberg’s compensation. But they weren’t. The indictment reveals that from 2011 to 2018, Weisselberg’s compensation remained fixed at $940,000, with $540,000 in base and $400,000 in bonuses that could be paid via one or another of these slushy tax dodges.

For example, from 2011 through 2018, his compensation was fixed at $940,000, to be comprised of $540,000 in base salary and $400,000 in end-of-year bonus. However, at Weisselberg’s direction, the Trump Organization excluded from his reported gross income the amounts that were paid to him indirectly in the form of rent paid on his New York City apartment, tuition paid on his behalf to his family members” private school, the automobile expenses paid in connection with his and his wife’s personal cars, and the other items described above. Weisselberg, received the benefit of these payments, and the Trump Organization internally tracked and treated ‘many of them as part of his authorized annual compensation, ensuring that he was not paid more than his pre-authorized, fixed amount of gross compensation. However, the corporate defendants falsified other compensation records so that the indirect compensation payments were not reflected in Weisselberg’s reported gross income. Therefore, the W-2 forms and other compensation records reported to federal, state, and local tax authorities fraudulently understated the income that the ‘Trump Organization had paid Weisselberg. Weisselberg included the falsified information set forth on his W-2 forms when he filed his personal income tax returns.

So while the benefit to Weisselberg of all this alleged tax cheating was $1.76 million, he really wasn’t pocketing all that as a result (probably no more than $100,000 benefit per year). Effectively, the Federal Government, New York State and New York City were paying Weisselberg’s raises every year rather than Donald Trump — with one notable exception, explained below.

Here’s how it looks with each benefit over the years that Weisselberg received that benefit.

The table suggests two things (though someone smarter than me would have to do the math to prove it). First, starting in 2013, after he sold his house on Long Island, Weisselberg lost a significant tax dodge, the ability to claim he didn’t live in NYC, so at that point, his compensation would have effectively been cut $23,000 in the yearly tax dodge not paying NYC taxes had given him to that point. Then, in the period when Donald Trump was too cheap (or, importantly, too broke) to just give Weisselberg a raise like normal people, Weisselberg was just adding on the tax dodges: first, the paltry holiday gratuities, then the 1099 payments and the tuition payments.

In that period — which stretched roughly from the period when Trump first entertained running for President through his first year as president — Weisselberg was doing more and more tax cheating just to get paid the same (or adding roughly $100,000 a year income in the best scenario, but again, someone smarter than me needs to do that math).

And for at least two years, Trump didn’t even benefit from this scheme. For the first two years Trump Organization was paying Weisselberg’s grand-kids’ tuition, he was paying it out of his own pocket.

Beginning in 2012, one of Weisselberg’s family members began attending a private school in Manhattan. Beginning in 2014, second Weisselberg family member began attending the same private school. From 2012 through 2017, and as part of the scheme to defraud, Trump Corporation personnel, including Weisselberg, arranged for tuition expenses for Weisselberg’s family members to be paid by personal checks drawn on the account of and signed by Donald J. ‘Trump, and later drawn on the account of the Donald J. Trump Revocable Trust dated April 7, 2014.

As far as we know, Donald Trump has only made this kind of payment out of his own pocket when trying to buy off former sex partners. But for two years, he was paying part of Weisselberg’s compensation — the tuition of one grand-kid — out of his own pocket.

What I don’t understand is why — aside from loyalty — Weisselberg was allegedly willing to commit new kinds of tax fraud just to retain the same salary. Michael Cohen went along with these kinds of games, but when it came time, he tried (unsuccessfully) to cash in on all his years of being a loyal Trump crook. Did Weisselberg take on all this legal exposure out of loyalty?

Or was there something about Trump’s business that required them to squeeze more and more out of unpaid taxes just to stay afloat?

Update: This piece from Jennifer Taub is one of the most helpful pieces I’ve seen on why this was valuable for Trump.

It’s easy to see what was in it for Weisselberg and the employees getting the equivalent of tax-free income. But how would Trump and his businesses benefit from these give-a-ways? It’s a way to give employees higher pay at a lower cost to the company. Here’s a simple, but not precise example for a New York employee. If the company pays an extra $100,000 in cash compensation the net pay for that extra is around $72,000 after withholding and payroll taxes. Then the employee can use that money to pay expenses like private school tuition or car leases. But, if instead, the company directly pays $72,000 worth of the employee’s school and car expenses off-the-books, and the employee and company hide that, it only costs the company the $72,000 (which it can still finagle a deduction as some kind of business expense).

By hiding that fringe benefit income, by pretending that he was not a New York City resident, and by claiming tax refunds to which he was not entitled, as the indictment alleges, he deprived city, state, and federal tax authorities of approximately $1,034,236 all together. A large sum, to be sure, but one that’s probably already been or soon will be dwarfed by Weisselberg’s legal bills. Weisselberg allegedly owes more than half of that cool million in federal taxes.

She also notes that Trump knew about the apartment.

There is a section of the indictment accusing Trump Corporation, Trump Payroll Corp., and Weisselberg with conspiracy in the fourth degree. Allegedly they agreed with “Unindicted Co-conspirator #1” (who appears to be someone who works for Weisselberg (so it’s not The Donald) to implement the off-the-books compensation scheme. This part of the indictment goes on to enumerate twelve separate overt acts that were carried out by the conspirators in furtherance of the conspiracy.

[snip]

The very first overt act that seems to indicate the ex-president’s involvement was Donald Trump on behalf of the corporation entering into a lease around March 31, 2005 for an apartment in Manhattan on Riverside Boulevard (the Trump Place building). That lease had a rider that permitted only Allen Weisselberg and his wife to occupy the apartment and to use it as their primary residence.

Why is this lease rider important? Well, it communicates that the grand jury knows that Donald Trump knew Weisselberg was living in the apartment on the company’s dime. It also means that Manhattan District Attorney Cy Vance does not yet have enough evidence to bring to the grand jury to show probable cause that Trump was part of the underlying agreement that formed the conspiracy.

This is where the examination of the broader financial position of the Trump Org, its affiliated orgs, and Trump himself would be instructive. I, too, noticed this oddity about Weisselberg’s compensation, and I’d be willing to bet that the increasing creativity you lay out here is because Trump was in more and more difficulty financially. His golf courses were not producing the income he hoped to receive, various localities were pushing back against Trump’s plans for expansion and development (especially the Scots around his golf courses there), and that had to make Trump . . . unhappy. It’s hard to maintain the image of a successful billionaire when the money is going out faster than it’s coming in, and the loans are coming due.

What better way for Weisselberg to show his brilliance and make the boss happy than to make money appear like this! Trump loves nothing more than screwing people financially, and who better to screw financially that the very governments that try to screw him over with taxes, zoning restrictions, etc.?

As for the details here, I wonder if the “non-employee compensation” scheme was intended to replace the lost tax benefit from claiming a non-NYC primary residence. It’s roughly the same amount, and appears to begin shortly before the NYC taxes would kick in.

I don’t know if it’s safe to assume Weisselberg did this to show his brilliance and make Trump happy. Would need to know more about the relationship and what makes Weisselberg tick.

I think Micky Cohen’s comments are valuable here. In the small world of insiders in TrumpWorld, either you intuitively grasped what Donald wanted – reading his shouts, grumps, and body language – and gave it to him without his needing to be more direct or articulate, or you were history.

Weisselberg worked with Daddy Trump and Donald for decades longer than Cohen. He passed that test long ago. This was not isolated behavior dealing with a short-term problem or a change in circumstances. It was part of how these people managed their affairs and relationships every day.

In so many malign organizations, the person at the top rarely “pulls the trigger” or even gives the direct order.

Fascists, mob bosses, Trumps, etc.

I’d say it was more to have Weisselberg tainted so he couldn’t call foul on Trump.

Standard mafia/gang trick or initiation rite, no? Have them commit some kind of heinous felony to prove their allegiance? So Weisselberg was in all the way. Even now the allegiance is working, it seems.

I would guess Weisselberg was legally compromised much earlier, when he was working for Fred Trump Sr. Anything he did with Donald would have been same old, same old.

Yeah, prolly right. Oh well, a good theory for 6.3 secs of its existence…

You are correct in your assumption. Just look around trump’s administration, everyone willing to ‘dirty it up’ was in favor with trump It is the way he operates.

The fact that the payments were treated as part of Weisselberg’s compensation in the Trump Organization’s internal records suggests that Trump deducted them as business expenses. So this tax fraud has another aspect that implicates Trump directly and hasn’t been charged.

Indeed. Stay tuned.

Very doubtful, don’t get your hopes up. Trump famously doesn’t use email or text so good luck finding anything in writing from him implicating himself. Additionally, and more importantly, he’s already been very clear under oath in a previous deposition that he’s not the financial guy, that he pays people to be experts on that and execute accordingly. He’s also repeated that lately verbally to many people, and it’s a great, reasonable defense. He may sign the checks, but he’s signing them because Weisselberg told him to. He is not going to get in trouble for the current situation.

This argument about emails and text doesn’t make sense. We survived for 2 million years without it, and plenty of people went to jail for these kind of crimes before 1995…

I think “doesn’t use email or text” can be taken to mean more broadly, “He doesn’t put anything in writing,” at least not the shadier stuff.

And, if there is anything in writing, he’ll destroy it. White House peeps were kept busy piecing together the documents that he would habitually tear up. And Omarosa claimed that she saw him eat a note that Michel Cohen had given him. Cohen denied that it happened but, crucially, he did so some six months before he testified before Congress. I wonder whether anyone has revisited that with him since his break with his former boss.

“He may sign the checks, but he’s signing them because Weisselberg told him to. He is not going to get in trouble for the current situation.”

IAMENAL (I Am Most Emphatically Not a Lawyer), but… what? This doesn’t make any sense to me. How are you not legally responsible for things you literally sign off on? Anyone else have a comment on whether or not this is a plausible interpretation?

It all comes back to responsibility and intent with tax crimes. Don’t think about this in relation to your personal taxes, think about it in relation to being in a company. Trump was the CEO at the time, but Weisselberg was the CFO. Weisselberg is the subject matter expert (SME) here and he is the one certifying the strategy and the documentation. Trump’s defense will definitely be that the entire reason that you have a CFO is to be the financial expert. He’s going to say, “well, Alan said this was OK and was being handled properly. This stuff is really complicated and that’s why Alan is in charge of this, not me”. That’s exactly why NY is going after Weisselberg and not Trump, because Weisselberg’s name is all over the documentation.

Additionally, I’ve done a fair amount of RE development work in NYC. It’s really important to note that a real estate company, especially an NYC / NYS real estate company, at Trump’s scale and with the staggering size of the properties he owned, with all the different subsidiaries, strategic partnerships and licensing deals, is stunningly and deliberately complicated. In my case with development, my fintech-trained colleagues built very complicated financial and tax models that could only be developed, administered and managed with sophisticated computer programs. This is not the stuff that someone who is good at general accounting and business management does. This is an entirely different level.

The only way Trump gets in trouble is if Weisselberg flips on him AND has some sort of written documentation clearly showing that Trump knew about and understood the tax fraud. If Weisselberg doesn’t flip, Trump walks. If Weisselberg doesn’t have anything in writing tying Trump to signing off on Weisselberg’s strategy, Trump walks.

And this is exactly why all the Twitter and TV lawyers are nuts to have been crowing about Trump’s little rant at his rally being a “confession” and/or “statement against interest”. He is currently neither a defendant nor critical witness, and he may well never be. How you going to use it against him?? More importantly, rather than “establishing guilt”, I’d argue it is actually kind of exculpatory in that it tends to negate what in law is scienter, or knowing state of mind. Under the the NY tax code, that is a necessary element So the rally rant really is not anywhere near what it is being made out to be. Not yet anyway, it might be useful in the future, we’ll see, but I would not bet on it.

Specifically, under NY Tax §1804, they need specific intent to defraud. The argument is that he left it to the comptroller and accountants to handle, and this rant was to show how disconnected and clueless he is That is how I and any halfway decent criminal defense attorney would frame it.

Well, this is fucking depressing.

Thanks for the clarifications, though.

He’s also lied during depositions, and is known to be a micromanager who initials or signs off on everything.

But his deposition strategy has mainly been some version of “I don’t remember,” delivered with a wannabe-royal air of condescension. And you’ll notice that he became president. I wouldn’t bet on this sticking either.

Hard to forget when your employer, whom you happen to be the CFO for, pays your kids school tuitions out of pocket. A CFO that forgot that sort of thing would be a hard sell.

My best guess is that Little D told him “If you can figure out ways to make more without costing me anything, that’s fine.” Neither of them cared about “bending” the rules of course.

From the indictment, twice:

What does that mean? [I’m a finance dummy]

Marcy:

So, that would be 2012 to 2014. That year was an obsession of mine for a while:

https://www.emptywheel.net/2018/05/05/mueller-honing-in-on-trumps-inauguration-graft/#comment-735666

From that comment: WaPo:

As the ‘King of Debt,’ Trump borrowed to build his empire. Then he began spending hundreds of millions in cash. May 5 at 1:30 PM

One of the fascinating, albeit incomplete, aspects of the indictment is the glimpse into the various ways in which Trump/Weisselberg used all kinds of corporate entities of the larger Trump empire to serve the larger organization. (Paying Weisselberg’s bonus out of Mar-a-Lago and other entities — groups that Weisselberg did not otherwise work for — is an example of this.) In this case, though, the Revocable Trust is not corporate money but Trump’s own funds.

Trump put a chunk of his personal money in a Revocable Trust (meaning he can close the trust and take the money back, as opposed to an Irrevocable Trust, where the money is gone for good) as part of his tax planning. For him to put personal money into this suggests to me that Trump was operating on the financial edge here, and that the Trump Org did not have the corporate cash on hand to make this (relatively) small payment.

Interesting suggestion.

Alternatively, Trump et al. are just really sloppy with corporate formalities. For all we know, some Trump Org company could have reimbursed Trump personally for these payments. Don’t get the feeling they cared much about rules or corporate best practices.

Fits the pattern with how Trump paid Stormy Daniels. Trump is a worldclass miser, which tells us how important Weisselberg is to him, or he would have never put his Sharpie in his small, pudgy hands to sign those checks.

Revocable trusts are a financial tool that let someone with a lot of separate assets essentially consolidate them in a single place for greater control and easier management. The “revocable” part means the contents and terms of the trust can be changed by the owner.

They are often used to avoid or limit probate fights, and can provide advantages to the owner of a trust in the event of temporary (or permanent) disability in terms of control over assets.

https://www.nytimes.com/2017/02/03/us/politics/donald-trump-business.amp.html

[Welcome to emptywheel. FYI, link to NYT’s article “Trust Records Show Trump Is Still Closely Tied to His Empire” edited to remove Google tracking. /~Rayne]

Tax returns are important not only for government taxing agencies but also for lenders and anyone seeking to invest in a company. I wonder if Trump and Weisselberg were trying also to evade any lender covenant restrictions on executive compensation.

It’s possible but IMO, lenders knew they were dealing with Trump – not exactly the kind of borrower one would expect to comply with such a covenant. There’s one key exception and I’m going to add it to an update shortly.

By the time period relevant to this indictment, traditional lenders had stopped lending to Trump. To Rayne’s point, anyone who did lend to him knew what they were getting, and didn’t base their decision on credit risk.

While I’m not a business person, I can pretend.

It seems to me cash flow issues would lead directly to a barter system, especially among a company’s employees.

Liquidity would be very valuable. Banks could offer liquidity with loans against property (for a small fee of course). But what happens when that source of liquidity vanishes because of bankruptcies? Bartering would become a necessity rather than an incentive.

Thus if I ran a real estate business and banks wouldn’t back me, I would first trade assets for salaries among my employees. Then I would look for people with lots of liquidity willing to trade their liquidity for my equity. Friendly “investors” like Robert Mercer or Vladimir Putin would have huge influence with me.

A political campaign might even help alleviate my cash flow problems.

[SECOND REQUEST: Please use the same username each time you comment so that community members get to know you. This is your second user name; you’ve posted here more frequently as “milton wiltmellow.” Pick a name and stick with it. Thanks. /~Rayne]

With all due respect, duh. That’s kompromat in the form of economic leverage, the reason why so many have been worried since Trump announced his candidacy in 2015. His executive ninny son Eric Trump said in 2014, “We have all the funding we need out of Russia.”

And the continued rallies like last weeks are certainly an extension of the grift.

With similar due respect, kompromat and cash flow are not at all the same thing.

Cash flow is a problem most US businesses face. Kompromat is not.

It seems reasonable to me to explain a despicable Trump as a reasonable human being rather than as some sort of crazed demon who lives outside the normal influences we all face.

74 million Americans voted for Trump. I share the same hostility towards Republicans and Trump voters I see almost everywhere, yet I still think it’s important to understand my opponent. Otherwise the great destabilizing schism in US society will never be bridged.

The cash flow — or lack thereof — is the kompromat. Of course not every business is vulnerable, because not every business’s CEO/president is a potential candidate for U.S. presidency. ANY vulnerability offering leverage to a hostile entity is kompromat.

This is really elementary. I can’t waste more time on this and I’d really like it if you didn’t spend more space here in thread on this.

You can’t waste your time or your space so I must be quiet?

Okay.

[You didn’t respond about your username not once but twice and have now reverted to “milton wiltmellow.” Stick to this username. This isn’t just for our amusement but security purposes. And yes, you need to bring a better caliber of game here. /~Rayne]

The idea is that Trump forced him to engage in tax fraud or to take massive hits to his take home pay. That compromised Weisselberg, personally, in federal and state crimes.

I imagine that Trump is not the sort of guy who is happy if his subordinates are not comprised themselves.

Thank you Dr. Marcy.

Exposure, exposure, exposure. Of course Trump never wanted to reveal his taxes.

As Rayne suggested, stocking up on the popcorn for entertainment.

“I have legally used the tax laws to my benefit and to the benefit of my company, my investors and my employees. I mean, honestly, I have brilliantly – I have brilliantly used those laws.” Donald Trump

So, is Trump now a flight risk and will his kids consider cutting a deal? More to be revealed…

It’s possible they had covenants in their loan documents preventing them from directly increasing executive compensation without lender consent, giving them another reason to conceal to whom money was going. Do we know if the private school tuition payments were claimed by DJT Sr. as charitable contributions as DJT Jr.s Boy Scout dues were years earlier?

[Welcome to emptywheel. Please use a more differentiated username when you comment next as we have several community members named “Jim” or “James.” Thanks. /~Rayne]

We don’t know yet the full extent of Trump’s personal income tax filings, but if Weisselberg was responsible for filing this as a *business* charitable contribution it would likely have appeared as a count in this indictment.

We don’t know, but the NY AG and Cy Vance know.

My WAG is that they didn’t claim it as a charitable contribution, but rather figured out some way to (try to) justify it as a business expense.

It’s not an either/or thing. Some were marked as charitable donations, and others as business expenses. (Considering who it is we’re talking about, some items may have even been claimed as both.)

Which years do they have access to Trump’s federal tax returns for? Anyone know?

I hadn’t heard about that one, so had to look it up–because how much could Boy Scout dues be, even now? (I was a Girl Scout through my senior year of high school.) It was the smallest charitable donation his foundation ever made, and was reported around the time of the infamous Jamboree.

$7.

And I don’t remember for sure, but did Trump ever put any money of his own into his charity?

Imagine what kind of bog those IRS auditors he used to say were why he couldn’t provide his returns have been getting mummified in for the past 10, more like 15 years.

My kid has a small business which has grown from a few thousand in revenues a year to more than $300k last few years. I used to scrape his receipts off his van floor to put info together for the family tax preparer in the beginning and worried like crazy whether the mileage numbers given to the tax preparer were accurate for business use. Outfits like Trumps’ make me wonder how much of the entire system is built on hot air.

“Did Weisselberg take on all this legal exposure out of loyalty?”

I would argue yes, and I will predict now that Weisselberg will never cooperate or testify against Trump. He is going to do real prison time for the son of the man who hired him in 1973…Fred Trump. Weisselberg is going to walk the talk and keep his mouth shut like a true soldier of Trump’s silly mob.

I still also think that Trump will flee the country once Weisselberg is convicted and the Trump Org is out of business. Because clearly some DA or AG is going to get the courage up to indict Trump after these trials are done.

He probably doesn’t want to die in a helicopter crash!

I say Weaselberg flees with his bitcoins cache, Israel or Russia

Fleeing to Russia, the land of Polonium, would be extremely foolish. He couldn’t give Putin any more leverage than he probably has already, and he’d be in a setting where ‘disappearing’ would be like having the housekeeper do the dishes.

On Maddow last night, Mary Trump said pretty much the same thing, that Weisselberg will never flip. The kids, however, she thought, are a different story. She said that so far as she could see, Trump’s relationships with his kids were almost entirely transactional, meaning they will do what they have to in order to survive. Interesting speculation.

For this exact reason I think it’s highly, highly unlikely that Trump trusted his kids with anything questionable. Given that he runs his operation like a mafia boss, I guarantee that there were very few people (Trump, Weisselberg, Cohen and a couple of others) that were in on it, and I also guarantee that the only people that were in on it committed felonies for Trump without Trump getting his hands dirty that make them extremely hard to flip. Cohen is the best example – he did all the criming allegedly at Trump’s direction, yet Trump left zero paper trail and Cohen was dirty as all get out. The result is that Trump skated as usual and Cohen went to jail. Weisselberg watched all that happen and took notes.

Ivanka, yes. Eric, probably. Junior – who knows?

In the Westchester Theater case which was front page news at the time the accountant who took the fall (for Steve Ross) did not do time:

“Lawyers who follow the case say the United States Attorney’s office has been stymied by its failure to secure the cooperation of Solomon M. Weiss, assistant treasurer of Warner. Mr. Weiss was convicted in November 1982 of fraudulently arranging for Warner Communications to buy $250,000 of stock in the Westchester Premier Theater as part of a ”pattern of racketeering.””

He was sentenced to five years of community service.

Warner Communications (later Time Warner) is just blocks from Trump Tower.

The certification of Trustee for the DLT Revocable Trust says that it holds assets for the “exclusive use of Donald J Trump”, which I am wondering if that somehow stops DJT from using Weisselberg as the only fall guy here?

https://www.documentcloud.org/documents/3456956-Certification-of-Trustee

Not a direct answer to your question, but here is what fiduciarytrust.com sez about revocable trusts:

https://www.fiduciarytrust.com/insights/commentary?commentaryPath=templatedata/gw-content/commentary/data/en-us/en-us-ftci/trust-estate/benefits_and_shortcomings_of_revocable_trusts&commentaryType=TRUST%20&%20ESTATE%20PLANNING

Trump Payroll must be ground zero of nefarious tax dodges. Ditto Wollman all cash skating rinks.

If Weasel was getting these deals in lieu of pay increases to conserve cash then highly paid employees, most named trump, were probably getting the same.

Absent tax cheating, trump org, may have never been profitable

Trump spawn were living free at Trump Seven Spings in Westchester, which trump had set up as a tax dodge,similar to Weasel’s free housing in NYC, shoes will be dropping here , too.

Woah, are you saying that the Wollman rink only accepted cash from visitors? And probably payroll as well? Of course.

A lot of small businesses find it cheaper to be cash only, but I’d think a rink being run for NYC could manage to handle credit.

any way the private school tuition $$ could be given to the school as a “charitable donation” that could be written off in taxes?

If the school wanted to conspire to defraud the government, perhaps. Hard to say why a school would want to take that sort of risk, though, even if the school administrators lacked any sort of ethical compass. Quid pro quo exchanges of donations for favorable admissions decisions are widely suspected, but what you suggest goes a lot farther.

remember the bribes the celebs were doing to get their kids into elite colleges?

It is totally conceivable that Trump wrote checks to schools for amounts that covered tuition which the schools booked as tuition while Trump put it in the pile of “charitable donations” to be deducted from his income tax.

It is also not inconceivable that he simultaneously put in a chit to the Organization to be reimbursed for “business expenditures.” Why would such things not show up on this indictment? Because they are about Trump and the DA is keeping their powder dry re charging him until they have as strong a case as possible.

We don’t know that this is the case and DT could well never be charged. But the idea that he wouldn’t do things that are stupid or irregular contradicts all the behavior we saw from him as President.

Last night on one of the news segments about this, they showed a check dated in 2017 signed by DJT for $100,000 made out to the “Department of Education”. The even amount and showing DOE as the payee instead of a specific educational institution whose tuition was being paid was baffling to me. I wonder what the explanation for this is…

Trump promised to donate his income. That was him donating his quarterly income.

Oh man, did he take the loss of income as a write-down? ~smh~

Worked in a financial planning company for a couple of years as an intern, after going through some schooling and passing a nationwide exam; some years ago so my data retention may not be perfect.

Having a revocable trust is quite common. My wife and I have one. It is part of Estate Planning to designate person(s) to control your assets and finances, per your instructions, should you become incapacitated, and at time of death. The key thing is probate is avoided, so resolution of the assets distribution is more timely.

People can gift tax free. Used to be you could gift someone $12.5K every year (up to a lifetime limit). If you are husband and wife you could gift someone $25K per year tax free. Tax free to the receiver and the no tax implications for the giver(s). Don’t know current rules.

Estate Planning is a jungle of provisions that are often used by the wealthy to legally avoid taxes.

The school has to account for tuition in student accounts, and they have to keep tuition income separate from donations. Between their own board and whatever state accreditation agencies they have to deal with, they would be treading on some very fine lines if they tried such a scheme. Then there’s the possibility of getting indicted for conspiracy to commit tax fraud . . . Most importantly, the school has no incentive to charge someone no tuition and accept a “donation” of the same amount as the tuition instead. From their POV, it’s all risk and no gain.

Exactly. The existential threat for a school or college is that the IRS might revoke its charitable tax status.

That assumes that DT and the school communicated about the tuition payments. All he really had to do was to give a personal check to AW, or son Barry, made out to the school, and say to whichever W, “here’s for this year’s (or semester’s) tuition for the kids.” The W in question gives the check to the school, and they log it as tuition. DT notates that the check, made out directly to the school, rather than a person, was a charitable donation, and that’s what it is considered at tax time. Of course, if there’s an extremely careful audit, the ruse could be caught, but only a number of years down the line. The odds are good that it would never be noticed.

As someone who works with a charitable organization – I’m a pastor – the org is required to send a record of charitable contributions to all its donors at the end of the year, for them to use for tax purposes. This is especially important if you are talking about large donations.

Without a letter from the school acknowledging the donation, it becomes much harder to call it a contribution if the IRS (or state tax folks) come calling.

Trump may try this, but I can’t see the school giving him/Weisselberg a letter like that.

thanks all, for the replies.

I would imagine Mr. Weisselberg was in deep and continuing tax avoidance/evasion discussion with the Trump Organization’s CPAs. There could have been a number of tax avoidance/evasion reasons related to the capped Weisselberg compensation coming out of that. They may not have wanted Mr. Weisselberg’s compensation to raise a red flag to taxing authorities under reasonable compensation rules which would have triggered a more detailed look by the taxing authorities at employee compensation throughout the entire organization. They may have thought they could push the envelope by characterizing other payments in other companies as non-taxable fringe benefits. They may have believed that they had created too complex/costly a tax operation for the state or feds to understand or follow up. One of the ways the IRS decides to audit companies or large individual taxpayers is a cost/benefit analysis, i.e. what is it going to cost them in manpower and time, what is the probability they will find something material, and what will be the potential recovery. If the Trump Organization CPAs and Weisselberg had been successful at this for years (and would have been probably going forward except Trump was a fool to run for President and expose himself/taunt others openly) they would have been conditioned to it and kept it up. Not having any red flags for taxing authorities, like unreasonable compensation questions, is critical in this process.

Not the way that IRS decides to audit small businesses and self-employed individuals, for they will go to the mat to audit people making 50-100K a year. Once had a field audit; it took all day and then the auditor made up some BS about the tax I paid on a piece of equipment and forced me to amortize it along with the equipment instead of declaring it as tax paid–cost me $99. So the auditor saved face, and I never got audited again, but it certainly cost IRS much more than a hundred bucks to audit me.

I personally think it more likely that IRS is compromised and stays away from auditing the wealthy.

Mr. Weisselberg, and probably Donale Trump, is tied to Leona Helmsley for tax purposes at the hip.

Has Trump ever attempted to make the claim that he delegates check writing authority?

I know there was initially an attempt with the Daniels hush money to use a third party corporation to establish deniability, but I don’t know if he has tried to blame underlings for writing checks without his knowledge, in the way that his tweets were occasionally blamed on people like Dowd.

I’m curious if we will get to the point where the cover story is AW wrote the tuition checks without DJT’s knowledge, or we find out that Trump has used the threat of blaming AW for unauthorized financial transactions as leverage over AW.

He’d have a bloody hard time saying he delegated that since more than one accountant/financial or legal officer has said he signs or initials everything.

There’s the famous story of Trump signing the 16 cent Spy Magazine check

https://www.npr.org/transcripts/469209254

He’s definitely very much micro-involved when he wants to be. But there’s a side that runs a planned deniability racket and I am curious if that ever comes out here.

I hope it’s his narcissism which does him in, of which the micromanagement is a component. I keep running across these accounts in which he appears to refuse to let anybody else take “ownership” of what happened at Trump Org.

I figured the school checks running through Trump personally, then Trump’s trust (so, differently personally), was to keep the “outsider” school off of their trail, to avoid showing to the school (and any of the school’s auditors) that payments were made from Trump Org — i.e. they couldn’t just cavalierly whip off Trump Org checks in this situation.

Using the concept of “outsiders” to their schemes as the ones getting personal Trump/trust payments as a frame, vs. folks/places not treated like outsiders, I wonder what else is forensically discoverable pattern-wise. Like who else, besides e.g. Riverside (knowing Weisselbergs were on the lease) were considered “insiders” enough for Trump Org’s behavior to evade detection/triggers. In that example, it’s not only Trump being on the hook for knowing Riverside’s purpose (to house the Ws), but that it wasn’t concealed from Riverside (I’m not saying Riverside did anything wrong, just that it was OK, from Trump Org perspective, for them to know). Who/what did Trump Org consider to be a “safe space” and why?

Where are the places we can find Trump/W feeling safe due to an assumed lack of oversight or tattling (passive) versus potential partners in laundering/tax evading (active).

There are other patterns not clearly seen and noted along with who resides where; Trump has a habit of complaining vociferously about property taxes to media outlets, to the point where he ends up with a reduction in assessment. I’d love to know how that works. Is it like his SLAPP suit threats or is he providing cover for responsible persons in government to make the cuts? Was it all as simple as bribing tax authorities?

Yes- Were his noisy complaints the same type of call-and-response crap he does w Putin and everyone else, to include both invitations for dirty comers and implied threats like ~ ‘I know you know I know you’ve done me these favors before, you better do me better this time/ with this property I’m bitching about or you’ll be screwed.’ Trump as whiny Kompromatarian [People like Trump could probably get crooked bosses to fire straight workaday types, too.] Yeesh, this whole world is so dirty.

Though as my tired imagination flies I recall routinely giving them too much credit in their schemes, so simple brute forces (fear-based methods) are probably behind the main set of answers, with cheap and few carrots.

By disguising wages as business expenses, Weisselberg saved Trump from paying the 2.9% Medicare tax. Whatever benefit he got from being able to tell Trump about this little chisel may have been motivation enough.

[Welcome back to emptywheel. Please use a more differentiated username when you comment next as we have several community members named “Tom” or “Thomas.” You’ve also used three different usernames so far — Thomas, Thomas Brown, and DrT. Please pick differentiated name and stick with it. Thanks. /~Rayne]

Imagine if he did this with every management-level employee across all of Trump Org businesses, ex. restaurant and pro shop and golf course manager.

I want the Trump golf course books so, sooo badly.

The magnitude of any credible audit staggers the mind.

IKR? Massive investigation. This may be in part why we never see the 1% get audited; the businesses which made them 1%rs are extremely convoluted and very expensive to examine.

Makes a flat tax extremely appealing.

No, because the whole point is hiding income.

It’s a heckuva lot easier to chase a single thread than many. “Did you earn any income? Send in 10%,” versus combing through 2.4 million words of tax code which has bloated 2X times its size since 1985.

And it’s not getting easier with cryptocurrency in the mix.

We can all delve into the intricacies of endless tax returns and bank statements but the reason for these tax dodges is much simpler: You can’t run a dirty operation unless everyone is dirty.

The cheats and irregularities built in year after year into the compensation packages were intentional and served as Trump’s leverage over his employees. Not everyone had to be equally dirty, but everyone had to have at least one major sword hanging over his head. Weisselberg’s sword was arcane and incremental, but clearly illegal and the exact kind of thing a trained accountant would have a hard time denying in court. It was a sword sufficient for the man.

If Trump is particularly worried now, its because he has lost this leverage over at least one highly placed manager of his business.

Wish I had time to look at the indictment carefully and write a detailed comment, since I regularly handle tax controversies (including criminal cases). For now I’ll have to settle for this drive by post.

First, the manner in which the alleged tax fraud was done makes it much easier to get a conviction. Trump undoubtedly was aware of this. Once I have time to breathe professionally, I’ll give some careful thought as to motivation(s) for doing business this way.

Second, there is massive exposure here at the federal level for prosecution of one or more “Klein conspiracies” under 18 USC 371. I don’t know if NY has a similar provision in its criminal statutes. But the fact that there is massive exposure at the federal level causes me to ask the following question. Did SDNY have access to any of this evidence while Trump was president? And was Attorney General Barr aware of this stuff? If so, did he take steps to kill the federal investigation? If you are looking for a way to hold Barr accountable, I would have the IG’s office look at this.

Third, there is a long standing general policy that the feds won’t prosecute the same crime that is being prosecuted by a state. That being said, I had one client who was so good at pissing everyone off that he managed to get indicted by the feds and the state. So dual prosecutions are not without precedent.

Finally, I highly recommend Jack Townsend’s Criminal Tax Blog if you want to read intelligent comments from someone who is extremely well versed in this area.

Thanks for mentioning “Klein conspiracies”; I think many community members are familiar with 18 USC 371 as Conspiracy to Defraud the US but not term “Klein conspiracies” with regard to tax evasion.

Thanks also for the tip about Townsend at Federal Tax Crimes blog; he posted a preliminary analysis of the indictment yesterday. I’m scratching my head about item 9 with regard to the Wartime Suspension of Limitations Act, 18 U.S.C. § 3287 — does this mean it’s in the best interest of the U.S. **NOT** to terminate the active AUMFs because the statute of limitations is longer? Lots of reading ahead.

Come back when you have free time.

The War Time Suspension of Limitations Act generally suspends the running of statutes of limitations for fraud offenses against the government until there is an official declaration of the end of hostilities. The current version dates from WW2, and it seems designed for traditional wars that last a few years and end when one side clearly prevails. Few thought too much about it or imagined that it might apply to the Post 9/11 Endless War. That changed in early May when the Ninth Circuit issued an opinion in US v Nishiie, holding that the SOL for garden variety fraud against the government was extended by the current sporadic ‘wars’ in the Middle East.

Huh. I don’t remember hearing about US v Nishiie. Wonder if this War Time Suspension of Limitations Act will end up in front of this SCOTUS?

Thanks for elaborating on this, very informative.

The following is a pretty good summary of the Nishiie case and its potential importance:

https://www.dwt.com/-/media/files/publications/2021/05/052521porterrulingcriminalcasesfraudfederal.pdf

Whoa, holy Toledo, thanks for sharing that. We definitely need to leave an AUMF open until we get through all of Trump’s conspiracy to defraud the U.S.

And the 9th Circuit held there was no war nexus requirement. Holy schnikes, we need to keep an AUMF in place just to be able to chase all the fraud related to the relief funding for the pandemic, not just Trump’s white collar criming.

Thanks for that link, I really need to read that a couple times through. Wow.

Huh—some in the Congress have been working to end the AUMF. Now that any fraud committed over the past 19 year might be not subject to the statute of limitations there’s plenty of worry in Graftlandia? Interesting…

Until now I thought the need to terminate the AUMFs was absolute. Now I have my doubts because it may take a couple more years to sort out all the Trump criming. Is it worth the risks to keep one open and which one?

Naw, terminate the AUMFs. Worrying about civil liability that will never occur is a fool’s errand.

I always learn something new on this blog with its fascinating writers and really smart commentary. Rayne your input to this post through the comments is very helpful. And Dr. Wheeler you always pull together threads that i hadn’t considered. Thanks to all!

I don’t know much about tax cases, but parallel prosecutions by state and federal jurisdictions is not particularly uncommon. Old timers here will likely remember me whining about it in past years. There is a particularly egregious example going on right now where DOJ has descended on the other officers in the George Floyd killing while they were pending trial in the same state court that convicted Chauvin. In this Trump case, you read the indictment and have to wonder why the state is in the lead. The state literally pleads federal tax crimes. I join Rayne in looking forward to your analysis.

With respect to whether the federal authorities should charge someone who has already gone through a state prosecution, the DOJ Tax Division (which would have to approve any federal criminal tax prosecution) sets out its analysis of the Petite Policy (the general DOJ policy governing dual or successive prosecutions) at section 4.02[1] in the linked material:

https://www.justice.gov/sites/default/files/tax/legacy/2012/12/05/CTM%20Chapter%204.pdf

While I do not live in state with a state income tax that piggybacks on federal tax returns (and my experience in this area is consequently limited), my understanding is that it is relatively uncommon to see a federal tax prosecution in the wake of a successful state tax prosecution.

As I said before, I have no clue about tax specific cases, but do as to more traditional criminal cases. There is a difference between parallel prosecutions, i.e. effectively at the same time, and successive prosecutions. The Feds never used to really intrude on state court common law cases, unless (picture Rodney King or the Danziger Bridge case) something went awry, and then they came in to clean up. They are now flat out big footing left and right over state jurisdiction without the necessity of it. My question here is the Fed IRS “should” be primary, and they are not. Why?

Adding, while Trump was in office and with Barr running herd, it may have been wrong, but you can see how. But Biden has been in office for a while and there were decent people putatively in charge, even before Garland was confirmed. So, what were they doing?

I think the reason that the feds are not primary (even though the feds have the more significant interest to be vindicated) is simply that most of the relevant information was unearthed by the State.

I would hazard to guess that the IRS audits were focused on larger dollar issues, and did not even look at the mundane employee compensation issues.

As a practical matter, very few individuals or entities are subject to a full audit of all of their dealings; instead, using a risk-based analysis, the IRS rather quickly identifies a handful of potential large adjustments to pursue. The IRS does subject a handful of taxpayers to “research audits” every year. In these audits, the agency actually does look at every nook and cranny of the unfortunate taxpayer’s financial affairs in order to update its understanding of the statistical audit potential of tax return entries.

When the NYT did their piece on the Trump Organization, going back to Fred, there was stuff about IRS disputes with regard to property valuations depending on what the valuation was for. Although it looked like the discrepancies between 2 valuations of the same asset (one for gift tax purposes, one for loan purposes or something) the IRS settled for a much, much smaller ultimate value–closer by far to the low valuation than to the high one.

Part of the manufactured Trump myth is that he loves fighting tax agencies and other public bodies – and always wins. In reality, as with his litigation record, he often folds his tent and slinks away with the smallest – confidential – settlement he can get away with.

But I suspect his public fights with tax agencies also serve as cover – and a kind of parallel construction – for the behind-the-scenes arm-twisting and extortion he allegedly endlessly engages in, and through which he obtains preferential treatment.

Sure. But if you are the IRS and are going to select a target suspicious as all get out for a full audit, who better than Trump?

As to access the Federal Govt. already had the relevant tax return(s) information because the IRS is a branch of them. They could have gotten it freed up faster than the state.

There’s certain irony in Trump becoming the father of compliance. Previously, he accidentally increased compliance with Foreign Agents Registration Act. Lots of people started to pay attention in 2017. Same deal now: lots of people are gonna start paying taxes on perks.

It’s worth noting that POTUS and VPOTUS are subject to automatic audits: https://www.irs.gov/irm/part4/irm_04-002-001#idm140647862743984. One wonders what ever became of those….

Nice post – and graph. As you say, how much of a miser Trump is, how much he micro-manages, and how cash-poor Trump probably was leap out. (Keeps me wondering about the source of the cash Trump poured into his Scottish courses.) So, too, does how tax cheating was part of Trump’s personal makeup and management culture. It was an essential part of being a [made] man in the world of Daddy Trump, Roy Cohn, and some of the contractors and patrons backing various Trump projects.

I see a parallel in how being anti-union is an essential attribute in advancing into the management ranks of a manufacturing company. I see another parallel in the culture of corruption reputedly common among certain police departments – say, Serpico’s NYPD in the 1970s. That is, if you don’t take or share in the graft, you’re not part of the team. Instead, you’re a threat to be isolated or disposed of. That’s a candidate as the answer to your question.

The Trump organization is as much Allen Weisselberg as it is Donald Trump. Donald’s Mr. Outside, all drive and marketing, with an insatiable hunger and a keen eye for weakness and the jugular – and no hesitation in going for it. But actually accomplishing anything requires someone who knows what they’re doing, who has an eye for process, detail, and follow-through – and, in TrumpWorld, no hesitancy to bend or break the law and repeatedly lie about it.

Donald and Allen are knaves, and the bottom and top halves of the same playing card. Take Allen out of the equation and what’s left: an anger-filled Don and children incapable of managing their way out of a wet paper bag. There would be candidates eager to replace him, but I can’t imagine how a paranoid fantasist like Donald Trump would choose among them.

So, regardless of how the indictments work their way through the courts, an immediate effect upon the umbrella Trump Organization — and specifically Donald, his spawn, and their associated consorts — is a slow but increasing strangulation of the financial “expertise”, advice, and operations that have been available for all these decades. Death by a hundred cuts?

It’s certainly a major distraction to the principals. And it makes the Trump organization radioactive. Who would want to do a deal with it, wondering when the next indictment or conviction might fall? Its financial resources, necessary for it to fulfill any obligations, are also suspect, at best. A mountain of debt will shortly become due. Hard to imagine even an oligarch wanting to stump up a fraction of the money needed to refinance it.

Even Vlad was smart enough to not give the former guy a permit to build.

Been reading this blog for 4-5 years now. Just wanted to say I really enjoy your commentary. It always strikes me as insightful with flourishes of literary panache! I’ve learned so much reading the articles and seeing the different opinions in the comments. Keep fighting the good fight!

Cheers!

In a sane world, Trump supporters – mostly blue collar people who have taxes taken out of their paychecks – would be incensed about wealthy people cheating on their taxes. And the defense that “everybody does it” would make them even more angry.

Psychologically, it is an extraordinary thing that they remain loyal. They continue to revere someone who, in all likelihood, has done everything conceivable to incur their class resentment.

The reason Trumpers aren’t up in arms is propaganda which appeals to their personal failings. Many are racist and don’t care about Trump’s criminal behavior as much as they care that whites retain dominance in our society. Quite a few are libertarians/anarchists who enjoy seeing someone negating government authority. Still more are sold on the idea of prosperity gospel and have been led by bullshit like The Apprentice to believe that Trump is good because he has access to money and power.

It’s unfortunate there’s not a concerted effort to simplify the narrative of Trump’s criming down to universal values of fairness and integrity: what he’s done is unfair to all Americans and his dishonesty hurts them.

Rayne, this paragraph is some of your best writing to date; since it isn’t copyrighted, I am going to send it to every intelligent person I know.

yes, agree. I treasure Rayne’s pieces, her comments, and her anger.

I use my gift. :-)

(Quote by Rage Against the Machine’s Zack de la Rocha; art by Hugo Soares.)

Thank you for that comment, Rayne. It rang true.

I’ll agree–that was quite a statement. I’ve been saying since 2016 that much of Trump’s appeal to evangelicals is through the ever-more-popular “prosperity gospel,” and the equation of wealth with good. And I’ve received a good bit of grief because of that. It’s nice to see that at least one person agrees!

“Prosperity gospel” is an unholy fusion of Calvinism, where you are blessed in the next world by your goodness in this one, and cargo-cult thinking, where wishing for Stuff makes it happen.

“You can fool some of the people all of the time, and all of the people some of the time, but you can not fool all of the people all of the time.”

― Abraham Lincoln

“ You can fool some of the people all of the time..”

This Lincoln observation is definitive of the Trump cult.

We have to keep in mind that after a number of years in trumpworld Weaselberg was essentially unemployable at any normal organization, the cast of characters at trump were straight out of The Producers. trump never gave Alan any pay increases because he didn’t have to, Alan was stuck.

LOL No. Like there’s no other crooked organization out there who needs a compliant bookkeeper? Don’t underestimate how many businesses out there operate with two sets of books and never get caught.

I did say “normal” organization.

I think all the routine audits of the trump orgs just got transferred to the “A Team” at IRS, what has come to light thus far doesn’t inspire confidence in the IRS although much of the alleged cheating is state and city taxes.

I worked for a small privately-held company I thought was normal. The accountant was a trusted family friend who hired me to do administrative work. I learned eventually I only worked for a subsidiary of a holding company I didn’t even know existed when I was hired. I’d worked there for nearly a year when the accountant explained some odd things about bills which didn’t make sense to me; that’s when I discovered there were more than one company under the same roof and two sets of books. I left that company within weeks; the companies dissolved after the owner died. I am absolutely certain none of the other employees knew what was going on because it was both too simple and too complex at the same time, and only three people touched financial documents.

Fortunately the surviving heirs didn’t get fucked over like the widow of another company owner for whom I once worked; she had no idea her name had been fraudulently added to loans and subsequent liens and the bank and feds took his assets after he died suddenly. He was insolvent and she had no idea she was as well.

And then there was Fortune 500 company A which confessed to the employees it acquired from client Fortune 500 company B that it had lied to get the contract, “We told B anything they wanted to hear in order to win the job because we could make it up on contract revisions later.” It became clear over time it Company A’s habit to do that even with government contracts.

Normal companies doing normal stuff like machining, manufacturing, information technology; you’d even recognize the names of the Fortune 500 companies if I named them. I still wonder what other sketchy things happened at the other normal companies for which I worked during my career. We really need random audits of businesses of all sizes for taxes and other regulatory compliance because this stuff is far more common than the average non-accountant realizes.

Friend worked for a company where employees had no idea that the withholding from their checks was never sent to the government, until the IRS showed up and wanted to see paycheck stubs to match the W2s. (Friend had his stubs. A lot of people toss them after making the deposit.) They were still looking for the guy some years later.

Riverside or Riverdale?

Riverside Drive. The stereotype is of elegant old pre-war buildings with very large apartments with very large rooms. Nothing like the cheap overpriced glitz of typical Trump owned buildings. So AW probably had better taste than Trump & that’s why he lived on Riverside Drive, not a Trump godawful building.

Riverdale is several miles to the north, and while older houses their can be impressive & expensive mansions, apartments typically sell or rent there for about 1/5 or less what they do on the Upper West Side.

Riverdale is in the Bronx and a part of NYC. Riverside Drive is in Manhattan and also part of NYC.

Wow – thanks to all for a tremendous thread. I’m still trying to understand:

1. The question in the title of the post and how the Trump Org. benefited from paying Weisselberg with off-the-books apartments, cars and tuition. I see how that saved Weisselberg a million in taxes, but I don’t see how it saved Trump Org any money. Why didn’t they just rent out the apartment to a 3rd party and pay Weisselberg on-the-books so he could legally rent his own apartment? And why pay the tuition instead of just giving Weisselberg a raise so he could pay it himself. Then they could write off the additional salary paid to him. Why wouldn’t the company benefit from paying Weisselberg legally? I just don’t get it.

2. How Cohen could have gone to prison for doing Individual 1’s bidding for Individual 1’s benefit and Individual 1 never got charged once out of the WH. [At least I’ve stuck to the same user name, ever since I became “obsessed” with the outing of Valerie Plame back in the firedoglake days.]

Well, wouldn’t “ties that bind” explain it? Because there’s the long pattern of dodgy valuations and presumably other stuff, you have to keep everyone tainted to ensure loyalty. Someone paid legitimately could out you.

Barbara Res confirms this;

https://www.youtube.com/watch?v=0aTv_xL-Phc&t=1s

[Second Request: Please use a more differentiated username when you comment next as we have several community members named “Tom” or “Thomas.” You’ve used three different usernames so far — Thomas, Thomas Brown, and DrT, and now “Fuckratter” at 6:05 p.m. n this thread. Please pick differentiated name and stick with it. Thanks. /~Rayne]

1. Rent – because the rental-as-income didn’t require an outlay of cash for compensation, and the rental unit would remain an asset which could be amortized while a trusted associate kept an eye on the entire building while in residence. Depending on the market it may have made more sense to avoid a vacancy while waiting for a prospective renter with an intangible upside using Weisselberg’s presence in the building for marketing purposes.*

2. That’s a good question but the answer likely overlaps why Trump wasn’t charged with obstruction while in the White House after the Special Counsel’s investigation.

* Forgot to add that this rental-as-income to Weisselberg was posted as an expense to Trump Org, which means they got a write-off against income without a cash outlay AND they definitely didn’t pay 2.9% Medicare tax on Weisselberg’s rental-as-income as another commenter has noted.

Do we know if the unit was rent-stabilized? I wonder if there were some shenanigans with respect to the unit registration with the DHCR.

Excellent question. It occurred to me but I’m weak on how rent stabilization works; what happens if the building is sold? Does the rent stabilization change? If it changes how does it play into amortization?

In NYC the rent-stabilization goes with the apartment. Rents go up according to a percentage approved by a gov’t board, but there are also allowable increases that go with improvements (that gets complicated about what can and cannot be charged to tenants and how capital improvements effect monthly rents).

However, there is an upper threshold for rent-stabilized rent, and I find it hard to believe that Weisselberg lives in an apartment that was ever below that threshold. (If he did, the rent wouldn’t be a very big part of his compensation).

Thanks for that, helps a lot. I guess we’ll have to put this on our wash list of items to watch as the case unfolds.

Trump Tax schemes exposed in 2018

https:///ny.curbed.com/2018/10/3/17932632/rent-stabilization-laws-new-york-donald-trump

Probably not for this property, but in the past they had used various holding companies to overcharge the cost of heating boilers for rent controlled properties, so they got the skim for the boilers and then used the final claimed cost of the boilers to get an increase in the stabilized rent. That’s from all those boxes of stuff Trump’s uncle or someone had sitting in storage that the NYT was able to get.

I think you mean his niece, Mary Trump. She turned over many boxes of records from an older lawsuit that she was party to.

There is NO WAY that apartment was rent-stabilized in NYC! Once a rent-stabilized apartment reaches a certain “market-rate” level (through council-approved rent increases that take decades), the apartment is removed from rent-stabilized program. Likewise, any “new” unit (or many newly renovated units) that’s market rate is not eligible.

Like Drew says, certain improvements can trigger a rent rise: i.e., new refrigerator, appliances, etc. (And Trump Co used that to hike rents in the Queens Village development he owned back in the 1960’s — Woody Guthrie wrote a song about that. Turns out that Trump Co cheated on the refrigerator markups: 1) inflating the cost of the “improvement” in his report to NY State; 2) getting the rent level raised permanently on the NY State books b/c of the improvement. 3) stiffing the appliance vendor. I read some months ago in the comments to a NYT article that someone was suing Trump Co for the rent overcharges going back to 1968. Those Queens Village tenants have overpaid by thousands and thousands $ over the years, as each city-approved rent rise is based on the previous level. Total scam and cheat — no surprise there.

They have always been crooks

Transnational Crime Syndicate

(https://www.youtube.com/watch?v=jANuVKeYezs)

Thanks for the link.

I have now this song stuck in my mind…

Paying in kind instead of salary saved the company from paying certain payroll taxes. Also, the company was putting employees with unoccupied units that were not generating revenue. They were indeed putting those units on the market, thus forcing Weisselberg Jr and family to move quite often according to his ex.

Woof, didn’t know that, but makes a ton of sense for the greedy yet miserly yet scummy Trump Organization.

Trump: ‘One Law for Hungry Pizza Thieves, Another for Me’

https://www.dcreport.org/2021/07/02/trump-one-law-for-hungry-pizza-thiefs-another-for-me/

excuse my inexperience, but, having dissected the lovely indictment we all enjoyed receiving a link to earlier … two of the defendants are ‘entities.’

does a ‘person’ take that hit, and if so, any idea who it could be ?

this question will get lost over the next few days, but i’m posting it in case …

cheers to the faithful marcy and her faithful followers/commenters.

As I understand it, the business takes the hit, in the form of fines and other penalties, up to losing its licenses. (Restaurants and hotels lose liquor licenses, and usually go out of business or change owners.)

thanks.

On NPR this afternoon, someone (a woman) who was… former SDNY (?) said that Individual #1 is Matt Calamari, Trump’s former body guard now Chief Operating Officer. His name sounds like a character from The Sopranos.

Here is a Business Insider article saying he is being looked at but not yet charged: https://www.businessinsider.com/matthew-calamari-lawyer-says-no-charges-this-week-2021-6

Terminological note: the indictment uses the title “Comptroller” for Weisselberg’s former role and (as above) [not named] Jeff McConney’s current role at Trump Org. However, the correct title is “Controller”; I note this to avoid confusion as we’re discussing this (on Rayne’s post now and in the future, generally). While the roles are similar, “Comptroller” is usually reserved for government agencies, perhaps also non-profits. Further, news reports consistently identify the Trump Org “controller” (and there is no “comptroller” to be found, while there is, as we know, a separate CFO and controller).

I’ll leave the nuance-fleshing to one of our many business / accounting experts.

IANAWP. Wealthy people have complex cash flows behind what we common folks might term ‘our income.’ How did Trump paid and pay himself? Isn’t his signature at the bottom of various tax returns which state where his income comes from?

Recently in the news was the ProPublica expose—The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax—centered on legal tax avoidance. Their investigation lined up some of the means accountants for ultra wealthy persons use to lower tax bills.

ProPublica discovered the ultra wealthy sometimes borrow simply to create incoming cash flows. It is this kind of borrowing I wonder about in terms of Trump and his family. How did the Trumps support their incoming ‘personal’ cash flows? Did they monkey around with valuations of assets?

One currently unsupported sense of mine is that the main family players might use the same angles that other ultra wealthy people use, yet, at the same time, they might give their strategies the special Trumpian touch—where one of the goals is to go outside the legal lanes and game the system, and, as the saying goes, “laugh all the way to the bank.”

Thanks for all the expert weighing in on this post.

This comment made me remember that mysterious debt of $421 million that DT has coming due before long. I wonder if that will show up anywhere in the tax and/or financial records?

In the town hall he had with Savannah Guthrie, DT told her he didn’t owe that to Russia. Then a few days later, it was revealed that the Trumps had a bank account in China. So, there was some speculation about that.

One place that has not been discussed much, though, is Kazakhstan. I wonder if DT’s debt is related in any way to the $440 million looted from BTA.

“Felix Sater: Lawsuit Reveals Trump’s Ties to Him” – By James S. Henry and David Cay Johnston, 3/2/21

“$440 Million Looted for Never-Built Moscow Tower, U.S. Real Estate. At Center of Schemes: Trump Associate Felix Sater.”

…

“The documents alleging Sater’s illicit conduct are listed in the lawsuit brought by the city of Almaty, the largest city and former capital of Kazakhstan, and the looted BTA Bank in that city.”

https://www.dcreport.org/2021/03/02/felix-sater-lawsuit-reveals-trumps-ties-to-him/

Most wealthy persons have very professional accountants and business advisors who are very cognizant of the laws & take care to at least have good defenses available when they cross into gray areas of whether the tax avoidance is illegal. (Or perhaps, knowing something is illegal, but unlikely to be enforced or to have penalties that are insignificant for the person or corporation, they take care that there will be defenses against CRIMINAL prosecution.)

Trump showed, throughout his presidency, that he was VERY impatient with the niceties of legality–he thought he should be able to do whatever he liked & if he saw someone had done something he thought of as analogous, he wanted it done without paying any attention to the niceties that other person had gone through to make it legal (or not prosecutable, in any case).

Trump always surrounded himself with sycophants & people that he made very sure had gotten their own hands dirty for his sake. This makes me suspect that there is a lot of carelessness in Trump’s business practices and inside the Trump Organization. Now that there are real investigations & real indictments many of these shenanigans, as analogous as they may be to the things that very wealthy people do and get away with, may end up being fraudulent or otherwise criminal or at least owing enough taxes to make them collapse in the end.

And while Trump often affects the mob boss’s care to avoid certain kinds of direct statements or conversations about incriminating actions, he’s sloppy, far sloppier than John Gotti, for instance. So he only sometimes demurs from saying incriminating things, this may catch up with him in this context.

If you haven’t read Andrea Bernstein’s book, “American Oligarch’s: The Kushners, the Trumps, and the Marriage of Money and Power,” I highly recommend it.

This was a quick overview she did last June of the Trump MO.

https://www.pbs.org/wgbh/frontline/interview/andrea-bernstein/

thanks for referencing this — just read it and it is an excellent precis on trump’s methodology!

Bernstein was mentored by fellow-journalist Wayne Barrett, who also covered Trump’s shenanigans down in New Jersey. Her book really is a “tour de force” of details, not only of Trump, but also of the Kushners and their origin story. I got it from the library (!!!), and read it along with Mary Trump’s book, “Too Much and Never Enough.” While Trump is a menace, more importantly he’s a symptom of the deep rot of our American institutions.

As others have pointed out, this Just Security article provides a helpful summary of the indictment. It especially helps dismember the defense’s characterization of these payments to Weisselberg as a tiff over the payment of routine fringe benefits. https://www.justsecurity.org/77331/the-weisselberg-indictment-is-not-a-fringe-benefits-case/

Allen Weisselberg is not some hapless executive caught up in an arcane argument between his employer and the IRS over the payment of routine fringe benefits. Rather, he allegedly designed and perpetrated a payment and record-keeping system that resulted in a multi-year tax fraud. Weisselberg was a beneficiary of that fraud, but other executives and his employer were also primary beneficiaries. The societal harm identified already totals nearly $2 million. More is likely to be exposed as the investigation progresses.

One fraud not listed relates to the almost certain intentional underreporting of federal estate and gift tax payments (for which Donald Trump has had a lifelong hatred). In general, annual gifts that currently exceed about $14,000 must be reported to the IRS. (The amount was lower in earlier years.) The amounts are tallied and become relevant when a donor dies, leaving an estate above the then applicable estate tax threshhold (a threshhold Trump helped to raise substantially).

When a Trump entity – as compensation for Weisselberg’s services – pays something of value to someone other than Allen Weisselberg, but on his behalf – $50,000 in private school tuition, for example – the payment is both income to Weisselberg and a gift to the beneficiary. That amount should be reported to the IRS in the year it was made. The cumulative amounts of gifts made on Weisselberg’s behalf are substantial. And after more than four decades of working for the Trumps, a CFO paid nearly $1 million/year is likely to have an estate subject to tax.