I want to pull several salient facts out of the indictment against Trump Organization CFO Allen Weisselberg and Trump Organization rolled out yesterday. The indictment alleges that the Trump Organization paid Weisselberg and other Trump Org executives off the books in such a way that allowed them to underpay their taxes.

The purpose of the scheme was to compensate Weisselberg and other Trump Organization executives in a manner that was “off the books”: the beneficiaries of the scheme received substantial portions of their income through indirect and disguised means, with compensation that was unreported or misreported by the Trump Corporation or Trump Payroll Corp. to the tax authorities. The scheme was intended to allow certain employees to substantially understate their compensation from the Trump Organization, so that they could and did pay federal, state, and local taxes in amounts that were significantly less than the amounts that should have been paid. The scheme also enabled Weisselberg to obtain tax refunds of amounts previously withheld.

It goes through one after another way that Weisselberg was paid in this way:

- A lease on a Riverside apartment that was Weisselberg’s full time residence (which, scandalously, was not owned by Trump)

- For some years in which he lived in the Riverside apartment, the ability to claim he was not a resident of New York City and so avoid taxes there

- Private school tuition payments for his grand-kids

- Use of two Mercedes

- Cash to pay his holiday gratuities

- Some compensation paid by the Mar-a-Lago Club and Wollman Rink Operations LLC as non-employee compensation that he dumped into a Keogh plan (this appears to be the same scheme that the NYT described Ivanka being paid as a consultant under)

It makes it clear he was in charge of this system — the entire system, just not the part that benefitted him, but also the parts that benefitted his own kid and Donald Trump’s kids.

At all relevant times, Weisselberg had authority over the Trump Organization’s accounting functions, including its payroll administration procedures. He supervised the Comptroller of the Trump Organization, who managed the day-to-day affairs of the accounting department, including payroll administration, and who reported to Weisselberg. At all relevant times, Weisselberg was authorized to act on behalf of the Trump Corporation and Trump Payroll Corp, to formulate corporate policy, and to supervise subordinate employees in a managerial capacity.

Thus far I get how this is supposed to work: Weisselberg has thus far been charged only for the tax fraud that benefitted him. If he doesn’t cooperate, his kid will be charged for the tax fraud that benefitted him, and Weisselberg will also be charged for the tax fraud that didn’t benefit him but over which he was in charge anyway.

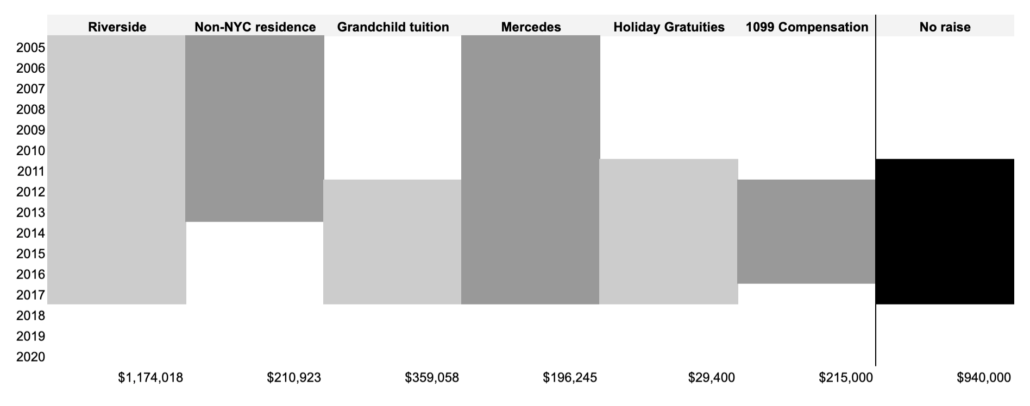

What I don’t understand is this. Before the indictment was revealed, some well-informed people had assumed that all the fringe benefits — the free tuition, the free car, the free apartment, the free tips — were on top of Weisselberg’s compensation. But they weren’t. The indictment reveals that from 2011 to 2018, Weisselberg’s compensation remained fixed at $940,000, with $540,000 in base and $400,000 in bonuses that could be paid via one or another of these slushy tax dodges.

For example, from 2011 through 2018, his compensation was fixed at $940,000, to be comprised of $540,000 in base salary and $400,000 in end-of-year bonus. However, at Weisselberg’s direction, the Trump Organization excluded from his reported gross income the amounts that were paid to him indirectly in the form of rent paid on his New York City apartment, tuition paid on his behalf to his family members” private school, the automobile expenses paid in connection with his and his wife’s personal cars, and the other items described above. Weisselberg, received the benefit of these payments, and the Trump Organization internally tracked and treated ‘many of them as part of his authorized annual compensation, ensuring that he was not paid more than his pre-authorized, fixed amount of gross compensation. However, the corporate defendants falsified other compensation records so that the indirect compensation payments were not reflected in Weisselberg’s reported gross income. Therefore, the W-2 forms and other compensation records reported to federal, state, and local tax authorities fraudulently understated the income that the ‘Trump Organization had paid Weisselberg. Weisselberg included the falsified information set forth on his W-2 forms when he filed his personal income tax returns.

So while the benefit to Weisselberg of all this alleged tax cheating was $1.76 million, he really wasn’t pocketing all that as a result (probably no more than $100,000 benefit per year). Effectively, the Federal Government, New York State and New York City were paying Weisselberg’s raises every year rather than Donald Trump — with one notable exception, explained below.

Here’s how it looks with each benefit over the years that Weisselberg received that benefit.

The table suggests two things (though someone smarter than me would have to do the math to prove it). First, starting in 2013, after he sold his house on Long Island, Weisselberg lost a significant tax dodge, the ability to claim he didn’t live in NYC, so at that point, his compensation would have effectively been cut $23,000 in the yearly tax dodge not paying NYC taxes had given him to that point. Then, in the period when Donald Trump was too cheap (or, importantly, too broke) to just give Weisselberg a raise like normal people, Weisselberg was just adding on the tax dodges: first, the paltry holiday gratuities, then the 1099 payments and the tuition payments.

In that period — which stretched roughly from the period when Trump first entertained running for President through his first year as president — Weisselberg was doing more and more tax cheating just to get paid the same (or adding roughly $100,000 a year income in the best scenario, but again, someone smarter than me needs to do that math).

And for at least two years, Trump didn’t even benefit from this scheme. For the first two years Trump Organization was paying Weisselberg’s grand-kids’ tuition, he was paying it out of his own pocket.

Beginning in 2012, one of Weisselberg’s family members began attending a private school in Manhattan. Beginning in 2014, second Weisselberg family member began attending the same private school. From 2012 through 2017, and as part of the scheme to defraud, Trump Corporation personnel, including Weisselberg, arranged for tuition expenses for Weisselberg’s family members to be paid by personal checks drawn on the account of and signed by Donald J. ‘Trump, and later drawn on the account of the Donald J. Trump Revocable Trust dated April 7, 2014.

As far as we know, Donald Trump has only made this kind of payment out of his own pocket when trying to buy off former sex partners. But for two years, he was paying part of Weisselberg’s compensation — the tuition of one grand-kid — out of his own pocket.

What I don’t understand is why — aside from loyalty — Weisselberg was allegedly willing to commit new kinds of tax fraud just to retain the same salary. Michael Cohen went along with these kinds of games, but when it came time, he tried (unsuccessfully) to cash in on all his years of being a loyal Trump crook. Did Weisselberg take on all this legal exposure out of loyalty?

Or was there something about Trump’s business that required them to squeeze more and more out of unpaid taxes just to stay afloat?

Update: This piece from Jennifer Taub is one of the most helpful pieces I’ve seen on why this was valuable for Trump.

It’s easy to see what was in it for Weisselberg and the employees getting the equivalent of tax-free income. But how would Trump and his businesses benefit from these give-a-ways? It’s a way to give employees higher pay at a lower cost to the company. Here’s a simple, but not precise example for a New York employee. If the company pays an extra $100,000 in cash compensation the net pay for that extra is around $72,000 after withholding and payroll taxes. Then the employee can use that money to pay expenses like private school tuition or car leases. But, if instead, the company directly pays $72,000 worth of the employee’s school and car expenses off-the-books, and the employee and company hide that, it only costs the company the $72,000 (which it can still finagle a deduction as some kind of business expense).

By hiding that fringe benefit income, by pretending that he was not a New York City resident, and by claiming tax refunds to which he was not entitled, as the indictment alleges, he deprived city, state, and federal tax authorities of approximately $1,034,236 all together. A large sum, to be sure, but one that’s probably already been or soon will be dwarfed by Weisselberg’s legal bills. Weisselberg allegedly owes more than half of that cool million in federal taxes.

She also notes that Trump knew about the apartment.

There is a section of the indictment accusing Trump Corporation, Trump Payroll Corp., and Weisselberg with conspiracy in the fourth degree. Allegedly they agreed with “Unindicted Co-conspirator #1” (who appears to be someone who works for Weisselberg (so it’s not The Donald) to implement the off-the-books compensation scheme. This part of the indictment goes on to enumerate twelve separate overt acts that were carried out by the conspirators in furtherance of the conspiracy.

[snip]

The very first overt act that seems to indicate the ex-president’s involvement was Donald Trump on behalf of the corporation entering into a lease around March 31, 2005 for an apartment in Manhattan on Riverside Boulevard (the Trump Place building). That lease had a rider that permitted only Allen Weisselberg and his wife to occupy the apartment and to use it as their primary residence.

Why is this lease rider important? Well, it communicates that the grand jury knows that Donald Trump knew Weisselberg was living in the apartment on the company’s dime. It also means that Manhattan District Attorney Cy Vance does not yet have enough evidence to bring to the grand jury to show probable cause that Trump was part of the underlying agreement that formed the conspiracy.