Revolutionary Changes in Economics

In this series, I tried to learn what Thomas Kuhn’s The Structure of Scientific Revolutions meant for economics. In this post, I suggested a possible paradigm for neoliberal economic theory. It uses the Ten Principles of Economics preached by N. Gregory Mankiw in his best-selling economics textbook, the general principle of maximization of economic efficiency, and a method suggested by David Andolfatto of the St. Louis Fed. Let’s assume the goals of neoliberalism fit the parameters described by Philip Mirowski in this article. I think my proposed paradigm can be used to generate the economic theory those parameters require, and I think that suits the goals of the people who fund academic neoliberalism just fine.

As Kuhn describes them, scientific revolutions take the form of a wholly new way to look at things, like an optical illusion. Where once our eyes told us that the sun revolves around the earth, now we know that it’s just the opposite. Not just is the earth not the center of the universe, we are on a small planet on the outskirts of a small galaxy, whirling around in a monstrously large physical space until entropy ends it. Since publication of Kuhn’s essay in 1962, there has been some discussion of such paradigm changes in economics, but as the series shows, I think old ideas do not die, but come back to haunt us, just as John Maynard Keynes said:

… the ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas. Not, indeed, immediately, but after a certain interval; for in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest. But, soon or late, it is ideas, not vested interests, which are dangerous for good or evil. Chap. 24 Sect. 5, The General Theory of Employment, Interest and Money.

I don’t know where Keynes got the optimism in the second half of that quote, any more than his seeming optimism about the end of laissez-faire theories. The ideas of Hayek and Friedman and their laissez-faire government-hating chest-beating right wing capitalism-worshipping true believers are still dominant nearly a century later. It just goes to show that if you capture the minds of the young, especially the young elites with textbooks like Mankiw’s, it’s mostly impossible to change their minds with mere facts and natural experiments from the real world.

Still, I think it’s quite possible to change some minds, or I wouldn’t bother with this. And there are new ideas, ideas just as revolutionary as any that Kuhn describes. One example is taxation. For centuries, people believed that the function of taxes was to provide the revenues to run the government. That may have been true in an age of gold. But in an age of fiat money, it’s just not true. Here’s a 1946 discussion by Beardsley Ruml, head of the New York Fed, explicitly stating this truth, and then offering justifications for taxation:

1. As an instrument of fiscal policy to help stabilize the purchasing power of the dollar;

2. To express public policy in the distribution of wealth and of income, as in the case of the progressive income and estate taxes;

3. To express public policy in subsidizing or in penalizing various industries and economic groups;

4. To isolate and assess directly the costs of certain national benefits, such as highways and social security.

This, of course, is the basis of Modern Money Theory. Here’s a quote from a readable and cogent explanation from L. Randall Wray:

But in the case of a government that issues its own sovereign currency without a promise to convert at a fixed value to gold or foreign currency (that is, the government “floats” its currency), we need to think about the role of taxes in an entirely different way. Taxes are not needed to “pay for” government spending. Further, the logic is reversed: government must spend (or lend) the currency into the economy before taxpayers can pay taxes in the form of the currency. Spend first, tax later is the logical sequence.

In the same way, most of us were taught that banks and other savings institutions were intermediaries between savers/depositors, and borrowers/investors. The role of the banks was to direct the accumulated assets of a society into their most profitable uses. No. Banks don’t need deposits to make loans. That idea, which I remember learning in Econ 101 at Notre Dame a very long time ago, is false. The bank merely makes book entries, one set to loans receivable, and one to deposits. This model is called finance and money creation in this 2014 paper by Zoltan jakab and Michael Kuhof of the IMF. Here’s the abstract:

In the loanable funds model of banking, banks accept deposits of resources from savers and then lend them to borrowers. In the real world, banks provide financing, that is they create deposits of new money through lending, and in doing so are mainly constrained by expectations of profitability and solvency. This paper presents and contrasts simple loanable funds and financing models of banking. Compared to otherwise identical loanable funds models, and following identical shocks, financing models predict changes in bank lending that are far larger, happen much faster, and have much larger effects on the real economy.

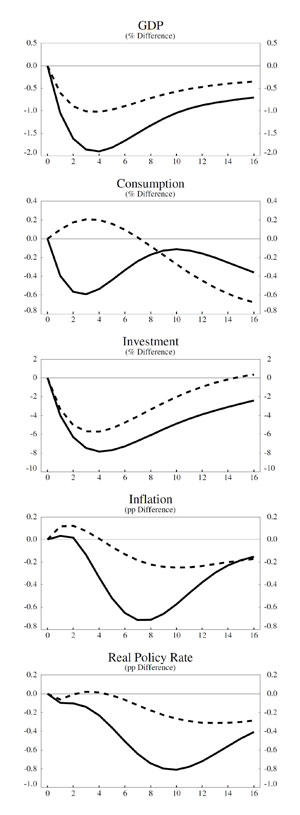

I remember learning about bank multiplier effects and the importance of reserves in determining the amount of money in circulation. It was one of those bizarre things that seemed logical until you realized that there was no particular reason to think any bank could or would actually lend all that money sensibly. Yet, as Jakob and Kuhof say, that is the theory incorporated into standard models of the economy. They create a new model using the financing theory, and get completely different predictions. These graphs are from the paper. The dotted lines are the predictions under the loanable funds model, and the solid lines are from the financing and money creation model.

At one level, this is just another reason to distrust economic models, because their basic assumptions are simply wrong. At another, it demonstrates that the standard paradigm is useless, because it treats the finance sector are irrelevant. And at another level, the new model demolishes the idea that the role of the bank is to intermediate savings. Savings are irrelevant to the main role of the bank, which is not to insure that savings are rewarded, but to make sure banks are rewarded.

Of course, such revolutionary changes won’t affect anyone not exposed to them and to their basis. And the wrong ideas will stay in textbooks for decades, insuring that generations will have them imprinted. No wonder nothing changes.

The proposed paradigm is set out here. In future posts in this series, I’ll attempt to show how each element contributes to the neoliberal economic theory that dominates the national discourse, and see whether I can find an optical illusion in each, leading to a better although not revolutionary understanding.