Treasury Threatens to Prosecute Reporters Trying to Reveal What Rod Rosenstein and Richard Burr Would Not

WikiLeaks supporters like to claim the May 2019 superseding indictment against Assange uniquely threatens journalism by treating routine journalistic activities — such as requesting sensitive information — as part of a conspiracy to leak.* That’s not entirely true.

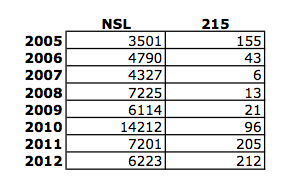

As I’ve noted, well before Assange’s superseding indictment, in October 2018, DOJ charged Natalie Sours Edwards — one of several presumed sources for a series of BuzzFeed stories on Suspicious Activities Reports pertaining to those investigated for their ties to Russia — in such a way to treat Jason Leopold as a co-conspirator. Both the complaint justifying her arrest and the indictment include a conspiracy charge that describes how Edwards (and another unindicted co-conspirator) worked with Reporter-1, including one request pertaining to Prevezon captured on Signal.

c. As noted above, the October 2018 Article regarded, among other things, Prevezon and the Investment Company. As recently as September 2018, EDWARDS and Reporter-1 engaged in the following conversation, via the Encrypted Application, in relevant part:

EDWARDS: I am not getting any hits on [the CEO of the Investment Company] do you have any idea what the association is if I had more information i could search in different areas

Reporter-1: If not on his name it would be [the Investment Company]. That’s the only other one [The CEO] is associated with Prevezon Well not associated His company is [the Investment Company]

On January 13, Edwards pled guilty to one charge, the conspiracy one, though without any sign of cooperation.

In fact, Edwards is not the only case charged like this. While he was charged after Assange’s superseding indictment, Henry Frese, a DIA analyst who leaked reports on China to some NBC reporters, was not just charged in a similar conspiracy charge, but was wiretapped to collect evidence implicating the reporters. Because he cooperated, there’s little to prevent Trump’s DOJ from charging the journalists after the election except Trump’s well-established support for an adversarial press.

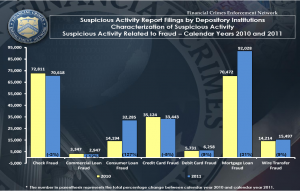

The way in which DOJ charged Edwards has become newly critical given an announcement Treasury made yesterday, in the wake of reports about how Donald Trump was never investigated for his financial vulnerability to Russia. The unit of Treasury that collects and analyzes Suspicious Activity Reports released a statement threatening “various media outlets” who were planning to publish stories on SARs.

The Financial Crimes Enforcement Network (FinCEN) is aware that various media outlets intend to publish a series of articles based on unlawfully disclosed Suspicious Activity Reports (SARs), as well as other sensitive government documents, from several years ago. As FinCEN has stated previously, the unauthorized disclosure of SARs is a crime that can impact the national security of the United States, compromise law enforcement investigations, and threaten the safety and security of the institutions and individuals who file such reports. FinCEN has referred this matter to the U.S. Department of Justice and the U.S. Department of the Treasury’s Office of Inspector General.

BuzzFeed has always treated their source for the Treasury story as a whistleblower, reporting not just a dispute over access to reports for intelligence reports, but also on the damning Russian information that got ignored.

As Edwards has moved closer to sentencing, she developed irreconcilable differences with her original attorneys over what she called a coerced guilty plea. And documents filed in the case provide some explanation why.

While the substance of her appeal is not entirely clear, it’s clear that she claimed legal access to certain documents — presumably SARs — as a whistleblower.

In the appellants “official capacity” as a government employee from 2015-Jan 2020 and as a whistleblower from 2015 to current, the specific documents were used during the Congressional Request Inquires & Letters from 2015-2018, the Office of Special Counsel’s investigations from 2017-2020 and the appellants legal access to the exculpatory material from 2018 to current per 31 C.F.R. § 103 “official disclosures responsive to a request from an appropriate Congressional committee or subcommittees; and prosecutorial disclosures mandated by statute or the Constitution, in connection with the statement of a government witness to be called at trial, the impeachment of a government witness, or as material exculpatory of a criminal defendant.1

As a government employee I could disclose any information in a SAR (including information in supporting documentation) to anyone, up to and including the person who is the subject of the SAR, so long as the disclosure was “necessary to fulfill the official duties of such officer or employee”2 which I did as a whistleblower and as an employee; however, once I medically resigned, 31 C.F.R. § 103 provided the legal exculpatory material as a whistleblower, administrative appellate and criminal defendant to disclose the information in court proceedings. Furthermore, the appellant was adhering to the courts upholding that disclosures must be specific and detailed, not vague allegations of wrongdoing regarding broad or imprecise matters. Linder v. Department of Justice, 122 M.S.P.R. 14, 14 (2014); Keefer v. Department of Agriculture, 82 M.S.P.R. 687, 10 (1999); Padilla v. Department of the Air Force, 55 M.S.P.R. 540, 543– 44 (1992).

After she tried to use the documents in her appeal of a whistleblower complaint, the Treasury Department Inspector General shared them with the prosecutors in her case, who in turn cited them in her presentencing report.

The agency has argued throughout the appellant no longer is an employee of the agency, the pro se appellant agrees. The agency Inspector General should not have been notified of the administrative proceedings of the court because the appellant is not an employee of the agency. There is no statue or policy that gives the agency the right to notify the agency IG of the “procedural motion” prior “to notify the other party”. Regulation 5 C.F.R. § 1201.55(a) does not state “notify Inspector General” rather it does state “to notify the other party”. The pro se appellant argues notifying the Inspector General prior to “the other party” is a violation of the pro se appellants fifth amendment.

[snip]

[T]he agency/agency IG notified the appellants criminal prosecutors of the disclosures in the IRA case. As explained above, the disclosures are permissible per 31 C.F.R. § 103. Due to the agency/agency IG notification to the government prosecutors, the prosecution requested increased sentencing in the sentencing report for the appellant/defendant thus violating the defendants fifth amendment in the criminal proceeding.

Edwards further claimed that the government withheld her original complaint to coerce her to plead guilty.

The Federal Judge found merit and significant concerns in the “letter and substantial documentation” the whistleblower defendant/appellant provided to the court concerning violation of fifth amendment, conflict of interests pertaining to the prosecution/counsel, coercion of the plea deal, criminal referral submitted against agency IG, the letter defendant sent to Attorney General Sessions and Special Counsel Mueller, etc., all elements withheld from the Federal court by both the prosecution and defense counsel.

Edwards has been assigned a new attorney (who may have convinced her not to submit this complaint as part of sentencing), and her sentencing has been pushed out to October.

There’s no way to assess the validity of her complaint or even her representation of what happened with the judge in her case, Gregory Woods. What her complaint shows, however, is that there’s a packet of information she sent to Mueller and Sessions (possibly implicating and/or also sent to Congress), summarizing some reports she believes got ignored.

If those reports show what Rod Rosenstein and Richard Burr worked so hard not to investigate, it might explain why Treasury is threatening legal consequences for reporting on them. And given how DOJ already structured this prosecution, they might well be threatening to treat reporting on the President’s vulnerabilities as a conspiracy to leak SARs protected by statute.

*WikiLeaks supporters also cite the risk of Assange being subjected to US Espionage Act prosecution. While that risk is real, in his case, the most dangerous charges (for leaking the names of US and Coalition informants) would likely be far easier to prosecute under the UK’s Official Secrets Act, which still could happen if he’s not extradited. The actions described in his indictment are arguably more explicitly criminalized in the UK than the US, even if their sentences are not as draconian.