Early Effects of NDAA Iran Sanctions Being Felt: EU Agrees on Oil Embargo, China Cuts Oil Contracts by Half

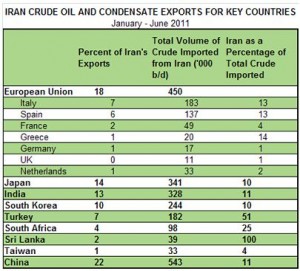

Iran's oil exports by country. (Click to enlarge) (From US Energy Information Administration; no, I don't know why China is at the bottom of the list)

Among the many controversial provisions in the NDAA which President Obama signed into law on New Years Eve are provisions aimed at disrupting Iran’s ability to export oil by punishing countries that do business with Iran’s central bank. Although the harshest sanctions on Iran’s bank don’t take full effect for another six months (and Obama says in his signing statement that he will regard the measures as nonbinding if they affect his “constitutional authority to conduct foreign relations”), Iran’s largest oil customers are planning to cut back dramatically on Iranian imports. The European Union has agreed in principal to a complete embargo on Iranian oil and China has already cut their imports from Iran for January and February to half their previous amount.

The moves by the EU and China will hit Iran very hard. As seen in the table above, China is Iran’s largest oil importer, buying 22% of Iran’s exports (but this only accounts for 11% of China’s overall imports), so cutting their order for the next two months in half will have a major impact on Iran’s overall oil revenues if replacement orders are not found quickly. The EU follows closely behind China, buying 18% of Iran’s oil exports. Note that these purchases are not spread evenly among EU nations, as Italy and Spain combine to account for over 75% of total EU imports of Iranian oil. Should the EU embargo actually take place, and even if China does not further reduce its purchasing, Iran is looking at a loss of about 30% of its oil export volume.

The Wall Street Journal describes some of the details of how the Iran oil sanctions are designed to take effect:

The bill specifically targets anyone doing business with Iran’s central bank, an attempt to force other countries to choose between buying oil from Iran or being blocked from any dealings with the U.S. economy.

Certain sanctions would begin to take effect in 60 days, including purchases not related to petroleum and the sale of petroleum products to Iran through private banks. The toughest measures won’t take effect for at least six months, including transactions from governments purchasing Iranian oil and selling petroleum products.

Reuters provides details on the status of the EU embargo:

European governments have agreed in principle to ban imports of Iranian oil, EU diplomats said on Wednesday, dealing a blow to Tehran that crowns new Western sanctions months before an Iranian election.

/snip/

Diplomats said EU envoys held talks on Iran in the last days of December, and that any objections to an oil embargo had been dropped – notably from crisis-hit Greece which gets a third of its oil from Iran, relying on Tehran’s lenient financing. Spain and Italy are also big buyers.

“A lot of progress has been made,” one EU diplomat said, speaking on condition of anonymity. “The principle of an oil embargo is agreed. It is not being debated any more.”

China is cutting its orders and is driving hard bargains on payments for the oil it is purchasing: Read more →