Newly-Released Dragnet Order Suggests Spike in 215 Orders May Include Financial Records

I Con the Record reissued less classified versions of two Section 215 orders: the March 2, 2009 one that sharply restricted the phone dragnet without much new declassified, and the June 22, 2009 one that dealt, in part, with FBI and CIA access to the data in both the Internet and phone dragnet, showing both those parts unclassified in the same order (previously the government had released two separate versions — phone, Internet — with different things declassified).

The only new document was a November 23, 2010 order, modeled closely on a December 12, 2008 one. The earlier one had judged that the Stored Communication Act’s limits on collection did not preclude the use of Section 215 to collect phone records. This one judged that the Right to Financial Privacy Act did not preclude the use of Section 215 to collect financial records. Both opinions basically find that because those laws permit the use of National Security Letters to obtain such records without judicial review, clearly it’s okay to obtain the same records with judicial review under Section 215.

Of course, we know that in the phone context — and so presumably also in the financial records context — the use of Section 215 also entailed bulk, potentially comprehensive collection. While some bulk collection occurred under NSLs, especially for phone records (we know that because that’s the only category of NSL that doesn’t get accounted individually in public records), and while we assume bulk collection occurred under Bush’s illegal program via other means, moving a new kind of record under Section 215 may represent the institutionalization of bulk collections of another type of document.

Aside from revealing that this order pertained to financial records, we don’t know much about the underlying order. The order says the records were provided to the FBI (though WSJ and NYT reported CIA used Section 215 to get money order records). It uses “financial records” in scare quotes, so it is possible it is something beyond just bank records. And the fact that it was stamped by John Bates (then the presiding judge) suggests it may have been regarded as rather significant.

All that said, this opinion doesn’t necessarily mark November 2010 as the date the government started using Section 215 to collect (presumably bulk) financial records. After all, the government collected phone records for over 2 years before answering the seemingly obvious question of whether doing so violated other laws. I suspect they did so in 2008 in response to questions then DOJ Inspector General Glenn Fine kept raising about Section 215. And it is perhaps instructive that Fine was, in November 2010, working on a new Section 215 review, one that has since been delayed, in part by ODNI and DOJ refusal to declassify a number of documents, for 1,371 days.

Perhaps it’s just a remarkable coinkydink, but Fine resigned 6 days after this FISC ruling was issued.

Two more details about this. First, as I have shown, DOJ appears to have been hiding details about Section 215 from Congress during this period, though the only financial records they would have been obliged to disclose were tax records.

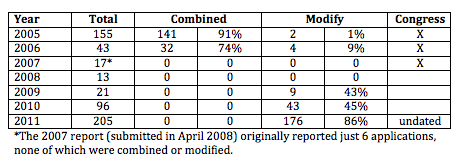

In addition, the number Section 215 orders started going up drastically in 2010, along with the number of orders the FISC modified to require minimization procedures.

Nevertheless, the reports show us two new things.

First, while we knew the number of modifications has gone up significantly in the last three years (we now know that many of the modifications in 2009 had to do with phone dragnet violations), the latest reports ODNI released say this:

The FISC modified the proposed orders submitted with forty-three such applications in 2010 (primarily requiring the Government to submit reports describing implementation of applicable minimization procedures).

The FISC modified the proposed orders submitted with 176 such applications in 2011 (requiring the Government to submit reports describing implementation of applicable minimization procedures).

I’ve suggested that 176 modified applications may suggest the government has as many as 44 bulk collection programs, which would be renewed every three months (or, alternately, a whole lot more specific bulk collection orders).

That is, this rise in what are almost certainly bulk collection orders came around the same time as FISC “Bates-stamped” the collection of financial records with Section 215.

Finally, consider one more thing. Last year, 26 Senators raised concerns about credit card records; last week’s RuppRoge House Intelligence Committee dragnet fix doesn’t prohibit the bulk collection of credit card records (their list, I now realize, is based off the list of sensitive records currently written into Section 215). Credit card records are covered under FRPA.

So while it would be a wildarsed guess, it would not be unreasonable to guess that some of this spike in bulk collection involved credit card records, approved by this November 2010 opinion.

Any bets we’ll finally get that DOJ IG Report on Section 215, showing that’s what they’ve been doing?

“old” eagle-eye mentioned in this article:

http://www.theguardian.com/commentisfree/2014/mar/29/surveillance-reform-whats-not-in-new-nsa-laws