Why Does Matt Yglesias Hate Exports, Innovation, and Productivity Growth?

I was interested to read this post from Matt Yglesias, which purports to prove that “nothing will bring back manufacturing employment.” Yglesias’ logic is that overall manufacturing employment is falling, largely because of more automation, and so we should stop pushing manufacturing in this country because it doesn’t get us the nice things in life. Here’s his key graf, which I’ll return to.

If you think about what the typical American family needs more of, it’s not manufactured goods. People need cures for illness and educational opportunities for their kids. They need more time to spend on leisure activities and with their family. They need jobs they enjoy. The idea of promoting more widespread affordability of health care services by boostering the share of the population that works in factories is a bizarre Rube Goldberg mechanism compared to directly focusing on improving the health care sector’s ability to deliver useful treatment to people.

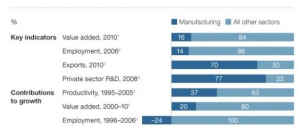

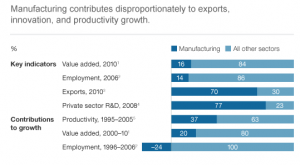

Before I get there, though, compare the graphic he uses for his post:

And the one in the McKinsey report he claims supports his argument:

See what he left out? The bit where his chosen source says,

Manufacturing contributes disproportionately to exports, innovation, and productivity growth.

That is, Yglesias stripped McKinsey’s title describing how important manufacturing is to a successful economy, including one that (if workers have some kind of workplace power, which is a big if) contributes to them having time to spend with their families and enjoyable jobs.

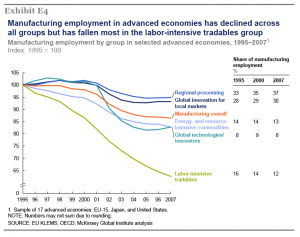

Here’s the graphic he should have used, showing that labor intensive manufacturing has nose-dived, while showing a decline–with a more recent slight up-turn–in more innovative manufacturing, and a decline then plateau in a number of other manufacturing categories.

And, as the text of the report makes clear, these labor intensive jobs haven’t just been outsourced; they’ve also been automated. That’s Yglesias’ point: this one kind of manufacturing is declining, and not just in the US.

That is, there’s a teeny part of the report that supports Yglesias’ point: these labor intensive jobs–which are different from manufacturing jobs, generally!–aren’t coming back.

But Yglesias has made those labor intensive manufacturing jobs stand-in for all of manufacturing, all while relying on a report that repeatedly insists that manufacturing is not monolithic. To be fair, I think Yglesias may actually believe manufacturing consists solely of those labor intensive jobs (he doesn’t consider, for example, that a key part of innovation in medical treatment involves medical devices and diagnostic machines that have to be–you guessed it!–manufactured, and are done so much better in close proximity to the treatment they deliver).

Underlying Yglesias’ treatment of labor intensive manufacturing as a stand-in for all manufacturing is a straw man argument he suggests–he does not voice it explicitly, but it’s the only way his formulation on the social value of manufacturing makes sense.

Manufacturing = only icky manufacturing jobs = no intrinsic benefit to society = poor policy investment

Now, as Yglesias’ source shows, manufacturing also includes a bunch of high tech jobs involving tailoring products to consumer needs. Those jobs are on the upswing, particularly in developed economies, as manufacturing focuses more on customization. They bring the kind of productivity improvements–for customers–that align with Yglesias’ description of all that is good in life.

As the McKinsey report also shows, manufacturing leads to and supports service jobs.

Manufacturing companies rely on a multitude of service providers to produce their goods. These include telecom and travel services to connect workers in global production networks, logistics providers, banks, and IT service providers. We estimate that 4.7 million US service sector jobs depend on business from manufacturers. If we count those and one million primary resources jobs related to manufacturing (e.g., iron ore mining), total manufacturing-related employment in the United States would be 17.2 million, versus 11.5 million in official data in 2010.

So while those labor intensive manufacturing jobs may not be coming back, to the extent we have manufacturing in this country, it does support a number of jobs that are not classified as manufacturing in the kinds of service sectors Yglesias more readily supports.

But finally there’s the key point that graphic Yglesias put into his own post shows: Manufacturing may make up a small portion of the actual jobs out there. But it is central to innovation and productivity.

What the country has been doing by emphasizing manufacturing is not–as Yglesias tends to suggest–subsidizing a bunch of labor intensive jobs in smoky 100-year old factories. Rather, to the very limited extent that Obama has invested in manufacturing more than his predecessors (which primarily consists of saving a domestic auto industry and investing in energy manufacturing), it has involved investing the bare minimum necessary to ensure our country participates in some but by no means all the industries that are driving key innovations.

A manufacturing policy is a jobs program as much through the secondary jobs manufacturing supports as through the manufacturing jobs themselves.

But a manufacturing policy is a competitiveness program because that’s where innovation comes from. Without that you don’t get some of the nice things Yglesias talks about–more leisure time and medical cures and more enjoyable jobs.

That’s where Yglesias logic collapses–in the “and so” I bolded above. Sure. We will never have as many labor intensive manufacturing jobs as we used to have. We will, depending on our policies, have more innovative manufacturing jobs than we have now, along with the service jobs that come with those manufacturing jobs. But if we make those policy choices, we will also renew America’s commitment to remaining at the cutting edge of innovation across multiple industries, something without which we can’t have a lot of the nice things Yglesias just assumes come of themselves. That’s what the policy debate is about, not those labor intensive jobs in 100 year old factories, no matter how much Yglesias would like to caricature it as such.

I agree with Yglesias on this: Americans don’t need more closets full of cheap manufactured goods.

But that is different from saying that Americans don’t want more sophisticated medical technology or smart phones that integrate cutting edge materials and electronics or safer, more efficient cars–and the attendant new technologies and service jobs that come with these things. And that is also far different from saying that Americans don’t want to be the most advanced country in the world anymore because their government and society just aren’t willing to invest in competitiveness the way the Chinese or Koreans or Germans are.

The logic of Yglesias’ post is that a country doing what it needs to to remain innovative and competitive is some kind of Rube Goldberg deal. That logic only sustains if you have a really outdated understanding of what manufacturing is. I don’t think that’s what Yglesias really believes, which is why he might want to read the McKinsey report he cited in some more detail.

Pity Matt hasn’t bothered to examine the manufacturing and investment policies of our principal competitors, especially China, Japan and South Korea. They favor manufacturing and employment, though less now than formerly, owing largely to US pressure. Chalmers Johnson rocked the boat a few decades back when he argued convincingly that such policies undergirt the Asian economic miracles.

Matt also ignores the human costs of the dog’s breakfast of inconsistent special measures that make up US manufacturing and economic “policy”. All pro-business and anti-labor. The sweatshops in America’s imperial possessions in the Pacific come readily to mind. So, too, do the OSHA-free processing centers in the “homeland”. Although not “manufacturing” as traditionally defined, operations such as cattle and fish butchering (and now factory hog rearing, e.g., as in North Carolina) exemplify the costs paid by workers and their communities inflicted by the unrestrained American business model.

Your point about tying closely medical equipment manufacture and use is another good one. Medical practices and terminology vary, both of which are included in the ground rules assumed in making and writing software for such equipment.

@earlofhuntingdon: And I think the tie between medical devices and practice is even closer. You develop these things with a prototype that has to be tested. To integrate the testing you need to collaborate with the doctors developing the treatment/diagnostics. And so on–a nice feedback loop you lose when you decide you don’t need that technological expertise anymore.

@earlofhuntingdon: And actually, butchering does count in manufacturing numbers, I believe. Food manufacture does, at least. Those are admittedly low wage jobs but I’d rather eat some of the stuff made at a Sara Lee or Heinz pickle factory 30 miles away than one in China. Beef, maybe not–I’ll opt for the two women form whom I buy my meat.

@emptywheel: I wholeheartedly agree about buying local, meats included. A local manufacturer/seller can be made more accountable, and not just in court. It beefs up local employment, and the possibility of local sourcing of ingredients. It may cost more, but the money goes to labor and local expenditures, not fuel, lobbying and import duties. It often tastes better and contains more food and less adulteration marketed as “healthy”.

As an aside, though admittedly a non-food item, you may soon be able to buy your Chinese made Twinkie, made with even more non-food ingredients than now (Not bad for an already non-food item; Twinkie De-Constructed, by Steve Ettlinger, is a good read). As Hostess shifts from a bankruptcy reorg to liquidation (brands and recipes will be snapped up), it’s useful to note its management’s de rigeur complaint that the decision was caused by labor costs, a claim about as genuine as the Twinkie’s contents.

Hostess had already settled with the Teamsters, its biggest union. Its pension contributions were high because of earlier underfunding – a management choice. Its management was incompetent, but paid itself up to 80% more while losing money. Standard American business model: blame the workforce while raiding the coffers and heading out of Dodge.

Jeebus. How the fuck does Yglesias think “cures for illness” happen? By immaculate conception, without anybody getting their hands dirty in manufacturing? My kid’s working for a biomedical firm that manufactures equipment for the entire health care industry. I might point out she LOVES her job, too.

And “educational opportunities for their kids” also isn’t immaculately conceived. Somebody has to make desks, chairs, chalkboards/whiteboards/digital boards, network devices, all the other accoutrements necessary to a classroom. Somebody has to make the software, the textbooks and/or digital content for e-texts, and I’d just as soon not trust China to do it for us.

I swear Yglesias is a perfect example of why the Take Your Kid To Work Day movement started a bit too late. He clearly has no clue how anything really works.

@Rayne: Yep, yep, yep. It takes a lot of work to make work. As Asian, European and 19th century US policies demonstrate, a big part of development success depends on governmental policies. The US was once a famous violator of foreign patent and copyright holders rights, which enhanced American growth, as it is now the biggest supporter of the fallacy that such rights (and their associated anti-free market monopolistic profits) exist to compensate the inventor and not to promote the public good.

For all the Beltway talk about economic “security”, it starts at home with sound governmental policies that support domestic businesses. We are not more secure when Washington subsidizes enormously profitable drugs, big ag and oil industries, while promoting the offshoring of our technology, software, jobs and know-how. One might almost be forgiven for imagining that the Beltway has forgotten whose economic security Washington is supposed to be looking out for.

An example from my experience fits directly with the kinds of jobs I think you are describing:

When I was starting my biotech company here in Gainesville many years ago, a startup from the same time period took the idea of both designing and building custom imaging probes for magnetic resonance imaging (hence their name, MRI Devices). They started with something like probes for elbows and just branched out to other body parts that did not fit well into the “off the shelf” MRI machines in hospitals. They wound up selling for about $100 million after about ten years and had grown to a staff of over a hundred since they kept all manufacturing in-house as far as I know. They really were just coming up with creative geometry for a few circuit boards attached to wound wires covered in a plastic housing, but they worked closely with the local orthopedists and imaging specialists to meet needs that the big imaging companies didn’t address. And then they got big enough that Philips bought them.

@earlofhuntingdon: The problem with the Beltway is it has benefited from huge stimulus in the Military Industrial Complex manufacturing segment, yet few there actually realize that this came from 1) stimulus and 2) to a large extent, technology-driven manufacturing.

@Jim White: Bingo. That’s how manufacturing works best. But it requires that retain the base technological capacity so that when someone has a manufacturing solution the means to implement it locally–where you can consult with the doctors who will be the customer–you can do so.

And why would anyone want to return to labor intensive manufacturing? That’s why there were Luddites. Seems Yglesias is intentionally setting up a straw factory.

Labor will continue to be automated out of manufacturing. Each step, each development, makes the next one easier and cheaper. There is a new generation of electronics for R&E, design, production and control every 3 years (see Moore’s law). Those are arguments for making more stuff here. The argument for off shoring was cheap labor. As labor becomes a smaller portion of the manufacturing process, and a smaller proportion of the cost of production, other factors, like distance to raw materials and market (freight in and out), become larger parts of the competitive advantage equation.

Increasing automation on a micro level is an argument for fewer jobs in one company or industry. On a macro level it is an argument for more high wage/high value added jobs through more manufacturing in diverse areas.

One small nit to pick, where is the evidence that medical equipment is different in kind from other manufacturing of end user goods? We are in a global market where many countries equal or exceed our medical environment. There is nothing special about being close to American patients for the development of medical equipment. Unless of course it’s related to obesity, we’ve got a corner on that market. But I digress, a heart attack is a heart attack is a heart attack the world around. That is not a reason to exclude US designed medical equipment, just that domestic basing does not convey much unique advantage.

Despite the rantings of the free enterprise dingbats, absolute lowest cost through screwing labor is not the only way to be successful. Comparative advantage shows shows another way. Ricardo laid it out almost 200 years ago, but today’s American bidness morons don’t seem to want to even buy a clue.

http://en.wikipedia.org/wiki/Comparative_advantage It’s been all brute force and quick hits, first head for Mexican labor at a dollar an hour, then abandon that for Chinese labor at a dollar a day. A few folks like Mittens have gotten fabulously rich, and the country has been left in ruins.

A future with the financial sector as the engine for profits, and the rest of the nation sinking into ever lower paid service sector jobs is a nightmare. That is our future in the making right now. That is the future Yglesias is shilling for, blow him a raspberry, and tell the president to say NO to grand bargains with evil.

What labor-intensive manufacturing stays around is likely to be highly-specialized products: parts for machines to build high-tech equipment, or for satellites, or other things that customers would rather not see made in China.

@P J Evans: Toolz is toolz. For example, IBM buys tools from Germany, Japan, all over the world, to fabricate semi conductors that go into its products.

Scariest part of our current defense technology is how globally it is sourced. Design often is global as well as component mfg, fabrication, firmware and software. It all stacks up into a final global product. Don’t suppose any of those nice vendors might bake a little back door code into device drivers for the hardware they build for us do you?

The Chinese rooted trojans in thumb drives a couple of years ago. They just waited for our dumb asses to use the drives to copy stuff between secure and insecure computers, and viola, they were in.

The Narus equipment NSA uses as part of vacuuming up all our communications is heavily Israeli derived, as are current Intel CPUs used in most computers. Don’t suppose they’ve left themselves access do you? I’m sure our buddy Bibi wouldn’t do that.

It wasn’t always thus. For a long time DoD felt it had an interest in maintaining domestic capacity to build our weapons and support systems. No more.

@lefty665:

1) My household is heavily engaged in the automation industry. There’s still a need for somebody to do the actual assembly of prototypes as well as assembly of the automation itself at a very minimum. Labor cannot be completely eliminated. Somebody still has to physically set up the robots.

2) The Ricardo theorem has a flaw. It’s called socio-economic and location-specific physical volatility.

— Fossil fuels become exorbitant in price, then local manufacturing is critical. Elimination of local manufacturing capacity creates increased exposure to risk from price increases.

— Upheaval at point of manufacture overseas due to politics or local currency improves case for local manufacturing versus outsourcing, particularly as incidents of assymetric warfare increase.

— Excessive concentration of manufacturing overseas can backfire, ex. persistent automotive parts shortages post-Fukushima quake.

We are entering a phase where increased volatility will be the norm, and global corporations cannot buy their way out of it.

Let’s also not forget the human component here; Maslow’s Hierarchy of Needs still applies. If humans who cannot do knowledge-based work do not have satisfying labor as an alternate, they will respond negatively due to perceived threat to their security. There’s a national security interest in assuring employment for laborers for this reason alone.

As for your comment, “tools is tools” — Germans would tell you otherwise. Germany protected its manufacturing base for years by insisting on German standards and specifications, i.e. forged and fabbed products composed of alloys not manufactured commonly in the U.S. and too pricey to make U.S. manufacturers competitive. There’s still not much American equipment in Japanese manufacturing plants for that matter.

How does growth continue?

Corporations and businesses seek and found only what was and is vital, thus they cannibalize by moving industry away, then claim growth, they destroy by fracking, then claim energy independence is near, they bankrupt the wealth creators, then claim average wealth is growing.

I’ve no idea how the people at this site think. You see things and draw conclusions, but ignore what’s not going on.

Growth stopped already. The numbers are there, the numbers are correct, but they are being presented upside down, reversed, and stretched in four dimensions.

Growth in the USA stopped. Improvements continue, we change in the old for the new. If done right, there’s a lessening in power use afterwards, but it’s not growth. We still use telephones. They’re more convenient by being wireless, but it’s not growth. The cell phone uses new technology to increase their usefulness, but it’s not growth. We travel by air in greater numbers, in newer jet planes, but it’s not growth. Selling more things next year is not growth, and more so counter productive, because those creating the gains in wealth see nothing from their labor and time spent, except the same as last year.

Fine, build the machines to provide people with what it takes, so they can then use their time, more so, to actually do the growing. However, as long as greed is the fuel, meaning the theft of wealth, growth will be impossible.

@lefty665: It’s not a medical device specific argument. Manufacturing advances come most quickly from being close to design and production. Here the doctor is just a nice human to point to, as the person who comes up with a new better way of doing things, but it’s often a product designer or someone working a process.

Where the US has failed–and one of the reasons we’ve lost our edge in so much manufacturing–is figuring we didn’t need “primitive” manufacturing like electronics, and when that manufacture went, and then the chips went, we lost the edge on things like batteries. Globalization works for some things, but for innovation it helps to have the entire process in teh same place.

@lefty665: I think defense is one of the reasons we’ll see more production returning stateside.

And not just for defense but for manufactureres that don’t trust their suppliers.

@Eric Hodgdon: I’m not sure why you think this is a post about growth per se.

I agree with you that our purported growth is largely kabuki. That’s largely because of the financialization of our economy, of which globalization is a part. That’s not the only reason–inequality also has capped how much American consume and we haven’t shifted away from consumer driven “growth” yet. Moreover, all this will quickly become moot as the world starts trying to deal with climate change and realizes they can’t push Chinese and Indians into cars at the rate they’ anticipate.

But that’s largely separate from the question of whether supporting manufacturing–effectively working against the trend of financialization–is good for Americans and whether it supports the things Yglesias lists as the good life.

@Rayne: and mine in IT, software development, EE on the electronics hardware side, and management. We should talk.

(1) You are right, there’s still a need for labor, I would never argue it can be eliminated (have you seen a modern scotch distillery? They’ve come close), but it is reduced as a component of manufacturing costs, and the nature of the work changes. There are fewer but mostly more highly skilled jobs, spread further across the entire manufacturing process/cycle from R&E through support after sale. More techies, less muscle.

I argue that the US can maintain manufacturing employment by embracing automation in manufacturing processes. That makes us competitive in low value added products by reducing direct labor costs per unit. That makes all the items you list have greater weight in the decision to produce locally or offshore.

Manufacturing communities thrive as capability and production expand. A web of suppliers and skilled workers grows up and provides economies and synergy (see late 19th century banjo manufacturing in Boston, or the mid-west as Detroit boomed). Today we can get numbers in jobs through diversity of manufacturing, not by putting masses of workers in front of punch presses. Those higher value added manufacturing jobs achieve the goals Yglesias touts.

(2) Please take another look at Ricardo and comparative advantage. It shows how in a mix of production, a country that does not have the absolute lowest direct costs anywhere can be competitive in some products in the mix. It is an argument for local manufacturing, not against. http://en.wikipedia.org/wiki/Comparative_advantage

In the short run we’ve allowed globalization and pursuit of short term profit by the finance sector and vulture capitalists to screw the country. That’s gotta stop. The whole idea of mixed capitalism is that representatives we elect will moderate the short sighted lust of the capitalist for profits today, and harness the energy of the private sector for the long term benefit of all, capitalist and citizen alike. It hasn’t worked that way recently.

Until our community activist and Constitutional scholar president gets some economic sense and decides to quit being led around by the nose on things from Wall Street to trade agreements negotiated in secret, we won’t get better.

Don’t ever discount Maslow, but I have long felt that rationalization should be added to the “Esteem layer”. To the point, the threat to the security of low capability workers is not perceived, it is real. However, adding labor costs to manufacturing to support low ability workers is a mugs game. Public sector supports that spread costs across the nation seem an appropriate solution, think CCC. That is a function of mixed capitalism that helps us all thrive and be secure.

Context for the “toolz is toolz” comment is as a response to a posting suggesting we have an interest, national security and otherwise, in maintaining domestic capability in high tech process automation. We do, but that ain’t the way it has worked. Look at a US semi conductor fab and you will find tools from all over the world working together. We’re not talking hammers and shovels, but way sub micron manufacturing equipment that can run a cool million per tool and you have to wear a bunny suit to approach.

@emptywheel: @15&16. Thanks for the clarification. You sure have the cycle right, been pretty dismal hasn’t it?

Guess one point I was trying to make is that globalization means the entire innovation process can be encapsulated and take place any place with resources. That includes right here in the US if we choose to.

The globalization of the supply chain in electronics, defense and otherwise, is scary. What could be better than to have an embedded “kill switch” that could turn off an adversaries or competitor’s equipment in time of conflict? However, there is value and some schadenfreude in anon. locking ORCA’s doors to keep Rove honest this cycle.

I’d also note that the web has changed what it means to be “local”. For example, I have employed programmers across the US, some of whom I have never met, to do specific pieces of code. Same works with collaborating on music. Send the digital scratch tracks, and the studio can be anywhere.

@Eric Hodgdon: Change the measures. GDP is flawed as a current construct of a nation’s economic condition, particularly given the $67 trillion in global unregulated “dark” banking not fully accounted for in GDP. Unlimited growth is not possible in a finite environment, after all. But regenerative activities that improve economic conditions and general welfare should be measured as a better aim of our direction.

@lefty665: In re Ricardo’s theorem — I spent plenty of time on this in my transnational management classes as part of my biz degree studies. We’re not going to agree on this based on our exchange so far. The theorem encourages states with comparative advantages to seek economies of scale, which over time may reduce competitive alternatives. Improved profitability then discourages product/service diversity in the same state, leading to increased risk for catastrophic failure (just add an earthquake…).

With regard to ensuring near-full employment including full capability: what’s the opportunity cost of failing to do so? Would we as a people rather spend more on policing the insecure versus spending on increased employment? What’s the cost of increased crime and other risk if we do not ensure near-full employment? This can be a win-win system, not a zero-sum game if society looks at all inputs and outcomes.

“Growth” is a phantom in many ways, as much of a phantom as the myth that the jobs will come if you encourage it. That worked sometimes when we were a manufacturing powerhouse stateside. But growth isn’t the issue, it’s a distraction from what kind of growth, where, and in whose interest.

The emphasis on “growth” accepts the framing of the managers of big businesses. It’s a distraction from the the public purposes for which good governments work: building and maintaining American communities, which means domestic jobs, housing, education and medical care. The American model focuses solely on the kinds of “growth” senior managers desire, the growth that enhances their short term compensation. (A redundant description, as managers rarely concede there is any other outlook other than short term).

A major flaw in the limited terms deemed acceptable in American discourse is that managers and their economists have exorcised politics from economics; in reality, they are inseparable, two sides of the same coin. That’s true here, too, but we are not supposed to notice the “politics”, the economic, social and political consequences for Main Street Americans, that our version of economic decision making brings in its wake.

Oh, and obscured in the recent brouhaha about the GOP’s now defunct policy paper on patents and copyrights is that US’s staunch support for endlessly continuing monopolistic profits on intellectual property strangles the purpose that makes those state-sanctioned monopolies legal: the public good. Great for big business, which hates free market competition more than Coke hates Pepsi. Bad for the public good.

N@Rayne: Expect we’ve got more areas to agree than disagree. Comparative advantage gets a blank dumb stare from most folks. Point I was trying to get at was that there is more to it than a global race to the dead flat bottom rape of workers to run a business and be competitive.

Agree, the opportunity cost of failing to employ people is huge, and the threat to our society dwarfs that waste of potential. At some point enough people without hope becomes unstable, and with good reason. Unmoderated capitalism is not a stable economic system. It seems we’ve spent the last 30+ years descending into a deregulated Randian dystopia, and that Dems, including Bill & Hill, have been feeding the flames.

Had my fingers crossed and worked hard for Change in ’08. By this time that year with Rubin, Summers, Geithner and their acolytes driving economic policy, it was clear we were getting a lot more Same and damn little Change. Why should we expect this day, after this election, to be different?

Best wishes for Thanksgiving. We might be able to work up a pretty good rant together.

@emptywheel:

The topic:

“…whether supporting manufacturing–effectively working against the trend of financialization…”

Historically the shift to finance destroyed my field of engineering, but it was through changes in laws and from the push, I think, to find funds to pay for the coming pensions and baby boom retirees, thus stealing future growth to pay for future expenses.

Financialization is the enemy because it’s not growth, so yes, manufacturing is better because it’s where growth comes from. Growth is only through and with labor. If this sounds Marxist, so be it, it’s still true – people doing things to create new things is the only source for growth.

Why does anyone think we call those builds which makes things “plants?”

Whether manufacturing can rightly supplant the financial is up to changing the laws and to educate correctly how these things work. But, as another comment indicates the climate disruption may lead us to a better way of living, but ….

@Rayne:

You hiring?