Jamie Dimon: The Face of America’s Free Market Politburo

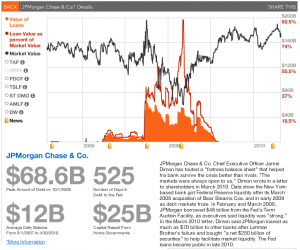

Sorry for the Jamie Dimon obsession today, but the extended article from his interview with the Financial Time is just as infuriating as his whining about “anti-American” banking rules. In this one, this so-called capitalist lays out his solution to mortgage woes: a Larry Summers figure should invite a bunch of public companies down to DC for a private meeting at which they’ll decide what the market will look like.

Meanwhile, the increasingly distant relationship between politicians and financial leaders has, Mr Dimon suggests, caused its own problems. In the 1990s, Larry Summers as Treasury secretary allegedly phoned a recalcitrant regulator and told her he had 13 bankers in his office who said proposed rules on derivatives could create economic chaos. Reformers saw this as supremely unhealthy. But a meeting between regulators, banks and investors could usher in a grand bargain over the future of mortgage finance, according to Mr Dimon.

“The right way … is to convene all the people involved in the markets, discuss all the plusses and minuses, talk about what you want, design a new mortgage market and go,” he says.

“We’re raring to go. If someone called me and said: ‘Come on down’, I’d get on an airplane and do it today. And so would every major bank.”

As it is, the various plans for mortgages – like other regulations – create overlap that ends up with an unworkable system, he says. “You could design several different types of mortgage market that would work but you can’t design a warthog – you can’t have it be non-recourse, pre-payable, fixed rate, 500 days to foreclose and think you can have a mortgage market. It’s got to work for investors, it’s got to work for everybody.”

Dimon (or the FT–this is a bit unclear) is advocating doing what Summers did when he forced Sheila Bair to back off her consideration of regulations on derivatives. Most people now believe that Bair was right in that dispute, that regulations would have limited the damage of our recent crash. But Dimon, it appears, would like to repeat the short-sighted decisions about regulation that got us into this mess.

And note how “all the people involved in the markets” for Dimon includes regulators, banksters, and investors, but no actual consumers?

Can’t let the riff raff into the Politburo.

Note, too, that Dimon’s promise that “all the major banks” would be at the table if called comes just a week after the banksters blew off Tom Miller and the other Attorneys General trying to give them a Get Out of Jail Free card for their mortgage servicing abuses.

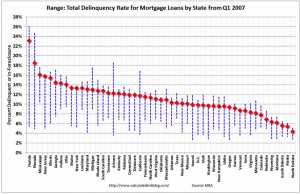

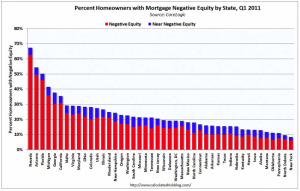

On that note, Dimon whines that the crappy housing market has held back the banks’ recovery. That’s like saying, “If people would just recover from their radiation poisoning more quickly, the country would be better able to recover from having nuked them.” There’s no self-consciousness here, no admission that the woes of the banks (and the economy generally) stem from the banks having marketed of a bunch of shitpile put together using faulty securitization in the first place.

In a normal recovery, some of these issues would diminish in significance. A resurgent housing market would not only help bank profits and cushion the impact of regulation but stem the lawsuits that have engulfed the industry.

If mortgage-backed securities perform better, investors have little incentive to sue for the way banks mishandled their construction.

If only investors didn’t have good reason to sue, they wouldn’t sue.

Which sort of makes clear that when Dimon complains about double jeopardy, he is again bidding for an AG settlement that releases the banks from their other shitpile liability.

But we are not there. “My guess is the legacy litigation is going to go on for three to 10 years because every securitisation is different,” says Mr Dimon. “We are geared up and we’ve hired some top experts that do nothing but this. We’ve put away billions of dollars [in reserves against losses] already. It’s an unfortunate drag on the company but we’re still looking at the mortgage business as a very important business going forward and these are legacy problems that will have to work themselves out.”

One litigation issue that participants say should be settled is the foreclosure mess, where banks improperly processed the mechanism for repossessing homes of people not making their payments.

State attorneys-general want a big financial settlement, including help for struggling homeowners. Banks, though, will only pay up if they get a broad release from future litigation. “Obviously some errors were made regarding who signed off on files,” says Mr Dimon. “We are working hard to settle these matters. But you can’t settle something and be subject to double jeopardy – that’s the issue. But we’re willing to be punished for what we’ve done wrong.”

Dimon, of course, is pretending that robo-signing fraud was the only crime the banks committed here, and that the big banks don’t have a range of liabilities.

Altogether, this poor capitalist is whining and bitching that the government is not helping banks avoid the consequences of their past decisions.