My oldest sent me a text this past weekend:

Also houses down here are going for 1.5x value. [Friend] put an offer in at 200k for house selling for 160k and it ended up selling for 240k. There’s no way it’ll appraise that high but EVERY house is selling like that.

Folks in big coastal metro areas will laugh at these prices, but until recently $160,000 bought a 900-1200 square foot home, three bedrooms and two bathrooms, a basement and a two-car garage in a suburban setting here in Michigan. At this price one wouldn’t find a brand new home but one between 10 to 50 years old, with a medium sized suburban lot. If one was really lucky, the house would be move-in ready, the yard would be fenced, and there might be a shed in the backyard for the lawn mower.

A young professional earning $80 to $100,000 a year could afford this and a family and still have a tiny bit left over to put in retirement savings.

But it’s a stretch at $200,000, and absolutely out of their range at $240,000. They may not even have the 20-25% down payment for this larger price, and the housing market has tightened so quickly they certainly haven’t been able to come up with an additional $20 to $40,000 to put down.

Wall Street Journal reported last week that as much as a third of single-family residential housing is now being snapped up by investors.

Big foreign investment firms that buy office buildings, hotels and shopping centers around the world have a new favorite real-estate play: single-family homes in American suburbs.

These institutions are partnering with U.S. housing companies to buy or build rental homes by the thousands. In suburban neighborhoods near cities such as Atlanta, Las Vegas and Phoenix, blocks of families are sending monthly rent checks to ventures backed by Canadian pension funds, European insurers, and Asian or Middle Eastern government-run funds.

The overseas investors are following in the footsteps of many big U.S. investment firms and pension funds, which started buying single-family homes on a large scale in the aftermath of the financial crisis.

This may well explain the huge jump in prices over the last 12-18 months.

The situation is so bad it’s become a joke on TikTok and Twitter:

Speculation is doing to residential property what it did to oil prices before June 2008 when Congress passed legislation requiring an increase from 10% to 30% margin on options. Oil prices then dropped greatly, but not enough fast enough to prevent economic Jenga – many mortgages failed because homeowners had to choose between a tank of gas to get to work or making their house payment.

~ ~ ~

Now imagine the frustration of a prospective house buyer like [Friend] above. They’re a two-career household with a small family, which means they have car payments, childcare expenses which likely exceed car payments, and student loans they’ll be paying down for at least another decade if they are trying to juggle all these expenses.

They’ve scrimped and saved, kept their lifestyle minimal – not hard to do if you’ve had to weigh going to the movies on a date night against the cost of a babysitter and movie tickets – and they’ve amassed enough cash to put down 20% on a house and been pre-approved for a mortgage between $120,000 and $160,000. The higher end would be a push for them but sometimes the right house is a little pricier.

And then the dream for which they’ve scrimped and saved is gone in a heartbeat. As soon as they see the house on market they bid but they couldn’t counteroffer enough money fast enough and it’s gone.

Even in a pandemic with so many people out of work, the right house is gone.

It’s probably been sold to a speculator who will put it up for rent at a price which is the same as [Friend]’s mortgage payment would have been, but at that price there’s no room to save any extra money.

And that’s what it’s like in the Midwest. What’s it like in more densely-populated coastal states?

How do young people who are competing for jobs on a national basis, earning pay which doesn’t adjust all that much for location, buy a home and attain the American Dream?

They’re giving up children to do this, we can see that by the flat to falling birth rates.

A major one. The National Bureau of Economic Research says that the largest component of child-rearing costs is housing. And the cost of housing in America has skyrocketed. The median U.S. home in 1953 cost $18,080, or about $177,000 in today’s inflation-adjusted dollars. Today, the median home price is $301,000. Young people who cannot afford homes or even a two-bedroom apartment are less inclined to marry and to have children. One 2014 study published in the Journal of Public Economics explicitly linked housing costs to fertility, suggesting that for every $10,000 jump in housing values, fertility among nonowners fell 2.4 percent. Economists also point to the fact that the fertility rate has fallen every year since 2007, and suggest that the Great Recession compelled many Millennials to put off child-rearing for years. “What we learned from the Great Recession is that every 1 percentage point increase in the unemployment rate reduces births by 1 percent,” said Wellesley College economics professor Phil Levine.

And in places like the greater San Francisco area they go homeless, living in their vehicles because they can’t afford rent *if* there’s rental housing available.

~ ~ ~

One solution to this mess is reducing student loan burdens. Getting tens of millions of young people out from underneath $50,000 and a decade or more of payments would free them to have children and/or buy a home.

I hesitate to say they may also save for retirement but it’s possible they’re not able to until they are out from under their student loans.

This problem may explain why so many young people have jumped at online trading apps like Robinhood, causing increased volatility in the stock market. They can get in with very little money, get out quickly, and do it all over again rapidly. It offers them a chance to increase their asset value though it does nothing for the overall stock market while compromising their personal data privacy.

But putting some portion of their meager savings in the stock market isn’t a solution — it’s far too risky, too easily gamed (hah, GameStop, get it?). It’s not a prudent approach to funding necessities.

Getting out from under student loan debt, though, would be a doable help with very little downside.

~ ~ ~

Removing at least part of student loan debt from younger consumers’ shoulders will act as an economic stimulus, too. Those who are able to end their loan payments will be able to spend more of their income on expenses they’ve deferred in addition to housing.

Employment should rise as demand increases, and a tighter employment market will help boost some if not all wages.

Which brings us to the section of the market which may not benefit directly from canceling student debt. Workers who make minimum wage or are employed in tipped hourly jobs can’t afford to buy the average home in the U.S.; they are struggling to pay rent let alone save a down payment. Many of them are students.

Do the math:

Minimum federal wage $7.25 x 40 hour week x 52 weeks = $15,080 a year.

That’s nowhere near enough to make a payment on the median home priced at $301,000. It’s not enough for a tiny dump of a house at one-third of median price.

The equation above already contains numerous generous assumptions: the employee makes 1) minimum federal wage, 2) at a full-time job, 3) for the entire year. For most minimum wage workers, at least one of these three points doesn’t apply. Most employers who hire minimum wage workers avoid paying unemployment taxes by employing workers less than full time, which means a minimum wage worker must work two jobs (or more) to make $15,080.

Forget about it if the worker holds down a tipped hourly job; while in some cases tips can be quite good, the base wage in at least 16 states is $2.13 an hour. On a bad day it may cost a worker more to show up than they make if they pay for any form of transportation besides shoe leather or a bicycle.

The minimum wage must be raised if roughly 1.8 million Americans have any chance at saving a down payment on a house, let alone buying one. And if businesses aren’t already increasing wages now during pandemic market conditions, they’re not likely to do so unless they’re forced to by law.

~ ~ ~

Canceling a big chunk of student loan debt and raising the minimum wage will still not be enough to help tens of millions of Americans afford to buy their own home.

Once these folks have more disposable income and increase demand on the housing market, speculators will swamp the market even more so than they are right now.

(Domestic policy aside, it’s a marvelous way to ratchet up class conflict by locking out a couple generations of potential homebuyers if a hostile country’s sovereign fund was looking to both invest and destabilize the U.S. at the same time.)

Canada’s domestic housing policy encourages home owner occupancy of single family homes; speculative investment is far less than it is in the U.S. It hasn’t solved their housing market problems — Toronto housing is incredibly expensive — but it does reduce competition for homes.

There must be some form of legislation which reduces market demand by speculators so that the only participants in the single-family home market are single families.

There should be some limitation on speculation for multi-family housing so that rental properties remain affordable. Eliminating overseas buyers or funds is one possibility.

~ ~ ~

We’ll hear all kinds of caterwauling about how unfair it is that some students will have all their debt paid for them by canceling $50,000 while they had to pay for all their student’s education.

Bah. They can suck it up.

This month I finished shelling out a total of $200,000 for two kids to go to college. This doesn’t include what I’ve paid for their cell phone, health care insurance, and for the vehicles and auto insurance they’ve needed.

$200K covered tuition, books, fees and some of the housing and food for one kid on a half ride to a private school, and a kid at a Big 10 public university. Both kids worked throughout their four-year programs and paid for their own gasoline and rent off campus, along with some sundries.

Because of this investment in them I’ve got to come up with income for another seven-plus years to pay for my health care, but at least my kids have a fighting chance right now that most of their cohort don’t have. They don’t need to live at home with me to scrimp and save. They can move out out state and chase a better job.

But even with this investment in both of my kids it will take years for them to save enough to make a down payment on a home and have a 6-month cushion in the bank.

I don’t resent the fact they don’t have school loans which might be canceled. What I resent is that they don’t have the kind of world I had as a young adult, where if one worked hard they could make enough money to get ahead and expect a better life. (I do resent having to pay through the nose, five to ten times over what I paid for college, but that’s another matter.)

If housing prices jump 20-60% almost overnight, my kids don’t have that chance. They can’t expect their friends to uniformly have that chance, either, as [Friend]’s situation demonstrates.

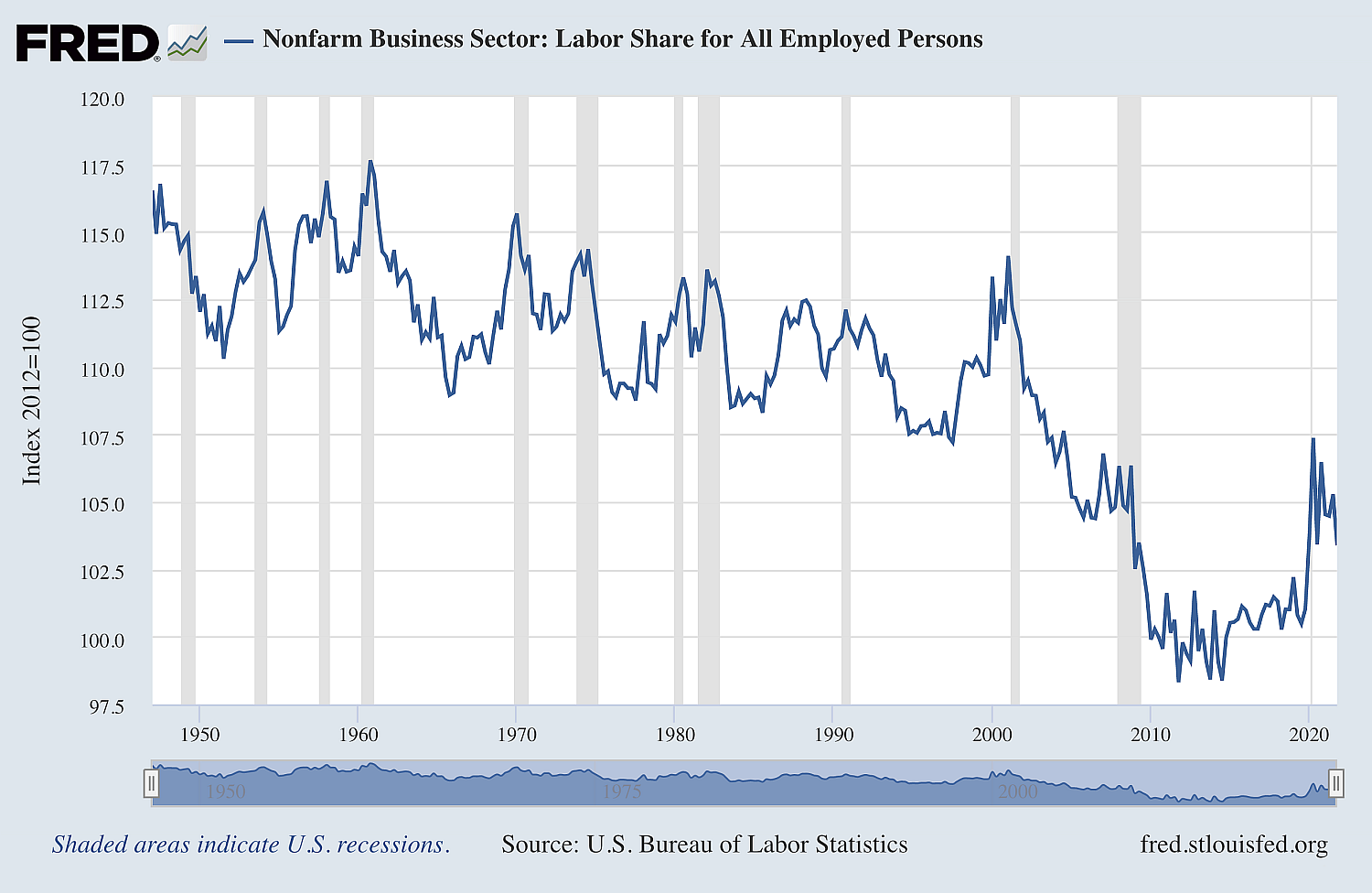

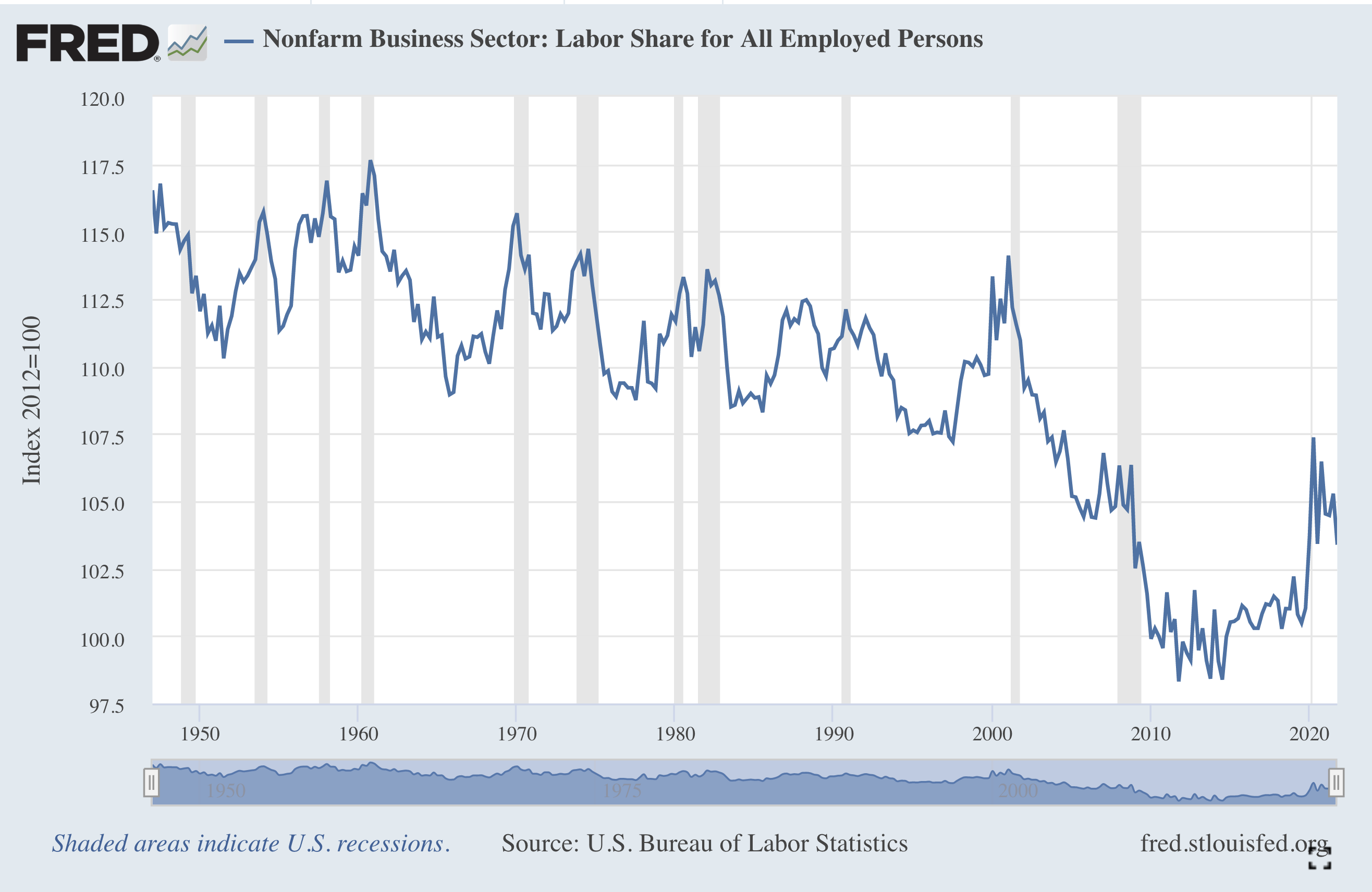

If their entire cohort is stifled by student loan debt, wages stagnant for decades, and competition for housing from speculation, even steep parental investment isn’t enough to help them tread water.

And if all of their cohort of 20-somethings are stuck in the same boat, the entire economy is deeply skewed and screwed. Whatever assessment analysts are making of the stock market and the economy is manipulated by this iceberg of frozen, frustrated demand which cannot remain in stasis forever.

Something has to give.

We can start with canceling $50,000 student debt, increasing the minimum wage to $15 an hour, and eliminating overseas speculation from the housing market while limiting single-family homes to sales between occupants and their heirs.

![[Photo: Emily Morter via Unsplash]](https://www.emptywheel.net/wp-content/uploads/2017/08/Question_EmilyMorter-Unsplash.jpg)