I complained last Friday about a long WaPo story describing how Trump thinks he’ll reopen the economy next month that, in its ninth paragraph, undermines the entire premise of the story by noting that, “The White House cannot unilaterally reopen the country.” The same paragraph falsely claims that states are following CDC guidelines, when the official social distancing guidelines fall far short of what most governors have now imposed.

In spite of all the focus this week on the fact that Trump doesn’t have that authority, WaPo continues to write stories like that.

This story, naming a rogue’s gallery of discredited economists (Hank Paulson, Stephen Moore, and Arthur Laffer) who are indulging Trump’s delusions about reopening immediately, admits in paragraph 8 that, “governors and mayors have the authority to impose or lift stay-at-home orders and to permit businesses and schools in their localities to reopen.” And this story, talking about a CDC/FEMA “plan” to start opening parts of the economy by geography (which is obviously just a slide show written to meet someone’s demand for a May 1 date, one that is not temporally possible), never actually informs readers that Trump has no authority to implement this plan. Instead, it just repeats Trump false claims to have that authority from yesterday’s presser unchallenged.

“The plans to reopen the country are close to being finalized,” Trump said at a White House briefing Tuesday.

He said he planned to speak with all 50 governors “very shortly” and would then begin authorizing individual governors to implement “a very powerful reopening plan” at a specific time and date for each state.

He said roughly 20 states have avoided the crippling outbreaks that have affected others, and he hinted that some could begin restarting their economies even before May 1.

“We think we’re going to be able to get them open very quickly,” Trump said.

He added: “We will hold the governors accountable. But again, we’re going to be working with them to make sure it works very well.”

WaPo did publish this story yesterday in which they admitted in the very first paragraph that Trump can’t reopen the economy.

President Trump’s inaccurate assertion that he has “total” authority to reopen a nation shuttered by the coronavirus is igniting a fresh challenge from governors scrambling to manage their states and highlighting a Republican Party reluctant to defy a president who has relished pushing the boundaries of executive power.

But it’s a horse race story that attempts to force Republicans to criticize Trump’s ridiculous comments, not a story claiming to report on how the economy will reopen. If the WaPo, in its stories purporting to describe how Trump will reopen the economy, only report that he can’t do so in asides buried deep in those stories, why would we expect Republicans to note how ridiculous the claim is?

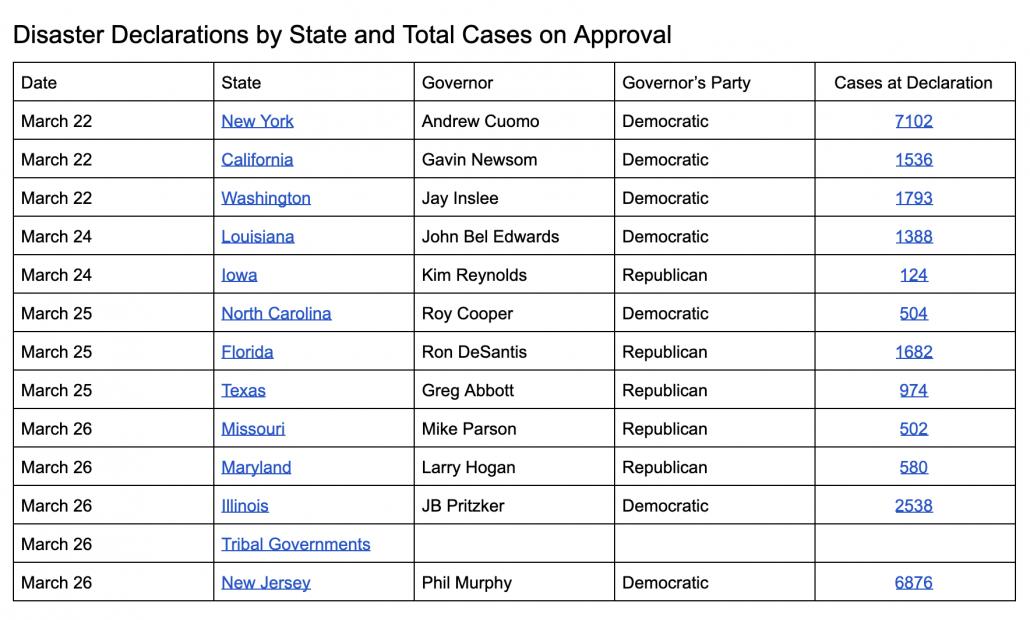

My working theory is that WaPo continues to get suckered into reporting extensively on Trump efforts that are a sidelight to the story of how the economy will reopen because they have so many journalists with good sources in DC, but far fewer in the capitals of the states that actually matter. Gavin Newsom, Andrew Cuomo, John Bel Edwards, and Gretchen Whitmer have some of the hardest decisions to make (and Republicans’ aggressive efforts to put Whitmer on the defensive here in Michigan is an interesting political story). The possibility that Gregg Abbott, Ron DeSantis, and (to a lesser degree) Tate Reeves will undercut the efforts of mayors in their states by overriding their city-wide shut-down orders in an attempt to reopen their states is a possibility worth anticipating, especially since that’s one point of leverage Trump already appears to be working (I think Brian Kemp would normally be included here but suspect he has realized he has a real problem on his hands).

But the real story about how the country will reopen can likely be found in Columbus, OH, Annapolis, MD, and Boston, MA, where Republican governors who’ve been working closely with — and to a large extent, leading — their Democratic neighbors are pursuing their own path.

Because Ohio’s Mike DeWine was quoted in several of yesterday’s stories saying something that was far less substantive than he manages on Twitter, I went back to see what WaPo has reported on him. On Monday, they published this interview between WaPo’s superb horse race politics reporter, Bob Costa, and DeWine. It offers key lessons, not just about what DeWine is thinking, but also about why Costa (who, again, is a superb reporter) didn’t elicit the key policy questions that elsewhere WaPo seems to believe is the key story.

DeWine made six key policy points:

States and localities need direct payments

Three times, DeWine emphasized the importance of direct payments to states and localities so they can deal with their budgetary shortfalls. After that, Costa asked DeWine specifically about Nancy Pelosi’s fight with Republicans to do just that (which seemed like an unnecessary attempt to get DeWine to contradict Republicans). DeWine pretended not to know what was in Pelosi’s bill, but repeated, a fourth time, that states and localities need direct payments.

MR. COSTA: Final question, Governor. Really appreciate your time. I know you’re busy. There is a big issue here in Washington. Speaker Pelosi wants 250 billion on top of the 250 billion wanted by Senate Republicans for small business expansion of that loan program that was part of phase three legislation. Where do you come down on how urgent it is to get a deal done in Washington? What specifically would you like to see in that agreement if it does come to be this week in Washington?

MR. DEWINE: Well, look, I’ve not looked at everything that’s in those respective bills. What I mentioned earlier on is important. It’s important that local government have the money that they can actually run local government. It’s important that the state be able to supply money for education. I mean, if you ask me what I’m worried about at the state level, I’m worried about that we’re not going to have enough money to provide K-12, our local schools, 630-some schools district in the state of Ohio with money. So, you know, I’m concerned about that. And so the federal government being able to help in that area would certainly be very, very, very helpful and very important to us.

In the interview as a whole, DeWine avoided antagonizing Trump and other Republicans. But on this issue, he clearly backs the policy that Democrats are pushing.

States — and corporations — need testing

Unsurprisingly, DeWine emphasized the import of testing to reopening the economy. But he also suggested that corporations are also thinking along these lines:

The other thing that we have not talked about here but I know is on the minds of governors, and certainly on my mind, is testing, how extensive can we have testing, how extensive are we going to be able to do tracing, and do that maybe more–in a more sophisticated way. So, those are things that private employers are looking at. I talked to a person who has a large retail business today, a nationwide company, and these were the things that he was talking to me about that they’re already looking at. Irrespective of what the state does, they’re looking at these things: how are they going to protect their workers, how are they going to protect their customers, how are they going to assure their customers that when they enter their store, you know, they’re going to be in a safe situation.

The nationwide retailer here may be Kroger, which is headquartered in Cincinnati and plays a critical role in the country’s food supply chain. But this is a key insight (and one that accords with what I’m hearing in Michigan). Corporations are going to play a key role in the public health process here, testing their employees and contact tracing in an effort to avoid having to shut down stores. This is one reason this won’t work regionally, because if (say) Kroger can solve this, then it will have an impact across the country.

Of course, the testing isn’t there yet, which is why Trump’s claims to be reopening the economy should be reported as pure fantasy and an attempt to dodge the federal role in testing.

There won’t be a Midwestern task force but there will be cooperation

Because the West Coast states and some Northeastern ones set up task forces this week, Costa asked DeWine whether there would be a Midwestern one. DeWine suggested it won’t be formal, but there will be cooperation.

MR. COSTA: Is it Ohio alone? You saw the news a few hours ago. The governors in the Northeast have formed a taskforce to try to figure out decisions in a collective way. Do you envision Ohio making decisions about Ohio, and Ohio only, or could you see a Midwestern collection of governors in a taskforce in the coming days?

MR. DEWINE: Well, I don’t know if it’s going to be a formal task force or not, but I can tell you that I talk to the governors that surround Ohio quite frequently. I was on the phone, I guess it was Saturday night, or Friday night with the governors of Kentucky and Indiana. I talked to the Michigan governor quite a bit, and so West Virginia. So, we certainly share ideas, and we collaborate in that sense because our states are generally in pretty much the same shape. Michigan certainly has been harder hit with–in Detroit, but we’re all kind of going through it in real time at about the same time period. So that consultation and sharing of ideas is going to continue and is very important.

This cooperation has been clear for some time (and because of the way traffic works, it is necessary). If Midwesterners do anything, especially Michiganders, they’re going to drive through another states, often as not on Interstates 70, 71, 75, 80, and 90 through Ohio. The auto industry, with a supply chain that links the region with factories in Mexico and Asia, sprawls across the region (although also some key southern states, notably Alabama). Plus, the states demographically blend into one another, with the same kind of challenges tied to Appalachia or Rust Belt health issues.

It is unsurprising (and, in fact, public) that this cooperation exists. But it’s also a far more important story to how the country will reopen than what Trump says in a presser.

In the DeWine’s Midwest, COVID-19 is a bipartisan issue

DeWine refused Costa’s invitation to antagonize Trump and acknowledged his cooperation with his neighbors, including Democrats Gretchen Whitmer and Andy Beshear. In addition, he made several other nods to bipartisanship.

As he always does, he emphasized the import of his Health Direct Amy Acton, who worked with Obama.

MR. COSTA: Your health director, Amy Acton, she’s been at your side since day one, was part of your decision to have an early response to the coronavirus pandemic. You’ve seen the retweet by President Trump. You’ve seen the news conferences. Dr. Fauci has been there. There’s now this chatter among some of the President’s allies, fire Fauci. Would you advise the President against considering that idea?

MR. DEWINE: Well, I don’t give the President advice?

MR. COSTA: Why not? You’re a governor in a major state.

MR. DEWINE: Look, I think the doctor’s done a good job, and I think he has a relationship with the American people. You know, Dr. Acton in Ohio has established really a relationship with the people of the state. And when I picked her, you know, she was the last member of my cabinet to pick, and I was going to be very, very careful of who I picked for that position. I wanted someone who had a background in public health, who was a medical doctor, but I also wanted someone with a passion to do it and someone who had an ability really to communicate with the people. And I made that decision having absolutely no idea that we were going to be dealing with this horrible coronavirus.

But that is important, the ability to communicate and talk to people. And I kind of jokingly tell people that, you know, I figured since Dr. Acton could explain it to me, if she could explain it to me, then she will have no trouble explaining it to the people of the state. So, but she has been by my side, and I’ve relied on her and other medical advice, you know, as we’ve gone through this. As we look to come out, we’ve put together a business group also to go along with our medical advice to help us as we move forward.

And he applauded the work of both Rob Portman and Sherrod Brown (and, not by name, the entire Congressional delegation).

You know, our two senators in our congressional delegation have done a very, very good job, Rob Portman, Sherrod Brown and the members of the House of Representatives, both Democrat and Republican. So, we work with them very closely just like we work with our local mayors. So that collaboration is important. We appreciate what they’ve done.

This is not a very sexy story in today’s DC, and it totally contrasts with Trump’s efforts to make COVID response into a series of transactions that benefit him, personally, but unlike the West Coast and Northeast coalitions of blue states, COVID in the Midwest is necessarily bipartisan, even if Republicans in KY, OH, and MI are focusing their efforts on challenging such bipartisanship in these states.

That doesn’t mean DeWine is conceding the election — he dodged a question about mail-in voting (though in part by repeatedly pointing out that no-excuse absentee voting makes that possible without more legislation). But DeWine is doing a lot to retain the ability to work in bipartisan fashion on COVID response.

DeWine doesn’t see reopening working like Trump wants it to

DeWine stated that “I don’t know that [Ohio’s reopening is] going to be geographical phases.” Trump’s entire “plan” is premised on such a geographical approach (and Stephen Moore, who’s not an epidemiologist, anticipates it rolling out by zip code). It seems to me an alternative approach — especially at the state level (though even at the national level if we had someone competent who believed in government) — would be to first shore up essential services like health care and food supply chain, and then slowly roll out each less essential part of the economy after we can prove the ability to do the former safely. In any case, I’d love to know more about what DeWine has in mind.

DeWine also said it’s not going to work the way “some people” think, with everything reopening all the way.

I think it’s not going to be coming back like some people think. And part of my job, I think, is to explain to the people of Ohio that we’re really not going to be all the way back–I said this today at our press conference–we’re not going to be all the way back until we have a vaccine that is available to everyone in the state.

[snip]

[I]t’s particularly dangerous to people with medical conditions, people over 60, over 65, 70, and people are going to have to be exceedingly careful. And some people are going to have to be more careful, frankly, than other people are.

This is consistent with what Anthony Fauci has said: we’re going to stop shaking hands, possibly forever. And, for seniors and those with pre-existing conditions, it will take a lot longer to get back to normal.

Prisons and nursing homes present key challenges

During the interview, Costa passed on a question about prisons from an Ohioan. DeWine responded by discussing prisons and nursing homes in the same way, as populations in which you can’t social distance.

MR. DEWINE: Well, we are releasing people and we are going to continue to look and see who we frankly feel safe in releasing. You know, these are not easy calls. They’re not easy calls because, you know, we don’t want to really turn back the sex offenders and murderers and others. But there are other people there.

For example, we just made a decision to–there’s an Ohio law provision which says that the director of prisons, if there is overcrowding, can release people within 120 days of their sentence ending. In other words, people who would have gotten out anyway within the next 120 days. We came with a whole group that we have recommended to be released. The legislative committee will look at that tomorrow, and I expect that, you know, they will be released. But we are continuing to look at that. We’re doing very significant testing in the prisons that have COVID-19, Marion Prison and our Circleville Prison. So, we are very, very focused on it.

And, you know, if you ask me of the things we worry about, at this stage of this epidemic, it’s any kind of congregation. Our nursing homes, we have put together a strike force to work with our nursing homes. But we’re very concerned about them. We’re concerned about our prisons. And any time that we’ve got people, a lot of people–a lot of people together where distancing is difficult, we have to worry about and should.

This has been an important point that — while Bill Barr has been making at times stumbling efforts to decarcerate (Josh Gerstein has been covering this closely) — hasn’t gotten sustained focus federally. Indeed, the federal government is not tracking nursing home outbreaks, at least not publicly.

You can have essential workers (including prison guards and nursing home workers) get back to work all you want, but each of these facilities has the ability to seed a new cluster of cases, not just within a prison or nursing home, but in the surrounding communities. And any head of government that is thinking seriously about how to reopen the economy needs to have a plan in place for that. Donald Trump doesn’t have one. Mike DeWine is at least working on it.

The Washington Post either thinks it’s really important to tell their readers how the country will reopen or they’ve been snookered by Trump’s aides into perpetuating a myth that that process will be led by the White House. If it’s the latter, that strand of reporting (which is separate from a great deal of good WaPo journalism on how Trump fucked up) is just as negligent as Trump’s own actions are, because such stories misinform about how this will work. If it’s the former, then WaPo would do well to send some journalists to work full time in Columbus, Annapolis, and Boston, or better yet, bring on some laid off reporters who know how those state houses really work. Because a handful of key Republican governors are the ones who’ll be making some of the most important decisions about how the country will reopen.

Update: As noted above, I named Larry Hogan as another of the GOP Governors where journalists should look to understand how the economy will really reopen. Hogan has just rolled out his plan. Unlike Trump’s plan, Hogan’s includes testing and means to limit transmission. It also does not yet include a date (not least, because as Hogan admits, the DC-Maryland-Virginia region still has a growing caseload.

Update: In spite of what DeWine said earlier this week, the Midwest just formed a pact. Maybe yesterday’s stupid protests in KY, OH, and MI forced this issue?